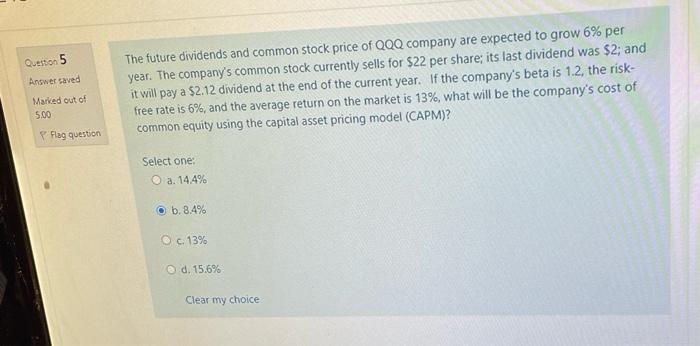

Question: Questo 5 Answer saved The future dividends and common stock price of QQQ company are expected to grow 6% per year. The company's common stock

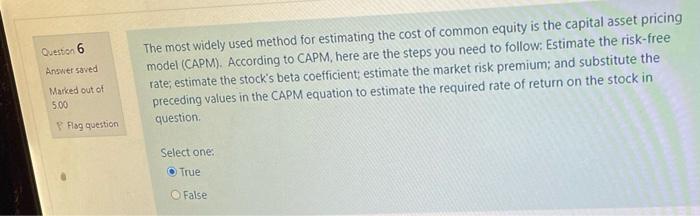

Questo 5 Answer saved The future dividends and common stock price of QQQ company are expected to grow 6% per year. The company's common stock currently sells for $22 per share; its last dividend was $2; and it will pay a $2.12 dividend at the end of the current year. If the company's beta is 1.2, the risk- free rate is 6%, and the average return on the market is 13%, what will be the company's cost of common equity using the capital asset pricing model (CAPM)? Marked out of 500 Flag question Select one: a. 14.4% b. 8.4% c. 13% d. 15.6% Clear my choice Answer saved The most widely used method for estimating the cost of common equity is the capital asset pricing model (CAPM). According to CAPM, here are the steps you need to follow. Estimate the risk-free rate, estimate the stock's beta coefficient estimate the market risk premium; and substitute the preceding values in the CAPM equation to estimate the required rate of return on the stock in question Marked out of 5.00 P Flag question Select one: True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts