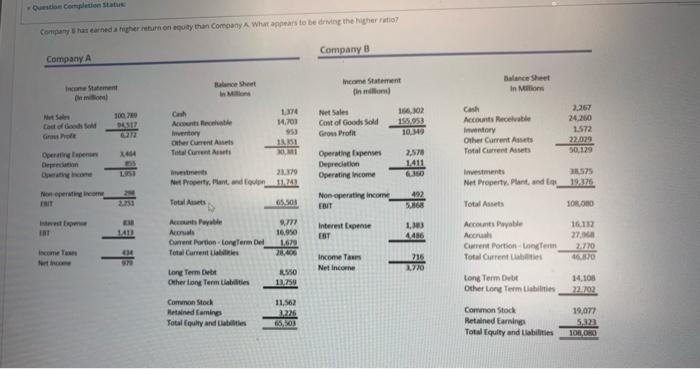

Question: Questo completion Status Company has earned a higher return on equity than Company A What appears to be driving the higher rati? Company 0 Company

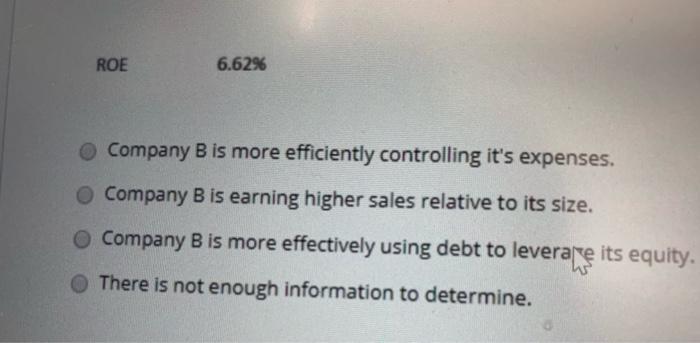

Questo completion Status Company has earned a higher return on equity than Company A What appears to be driving the higher rati? Company 0 Company A Blance Sheet Income Statement Balance Sheet In Mein Dim 162 Coul of God 14.700 Cash Aceh metry Other Current Total Current Net Sales Cost of Goods Sold Gross Profit Cash Accounts Receivable entory Other Current Assets Total Current Assets 2267 24200 1572 22.029 50.129 151 MI Operpen Operating Expenses Depreciation Operating income 1411 13.575 2007 Net Property. Plantand 1241 Investments Net Property. Plant, and Total Assets 65,503 Non operating income EBIT 422 5.868 Total Assets JOROND 1,183 2.77 16.950 1.622 Interest Expense EBT Als Current Portion Long Term Del Total Current Lates Accounts Payable Accrual Current Portionem Total Current Labs 16.132 27 2.770 100 Income Tours Net Income 715 1770 Long Term Debe Other Long Term Liabilities R$50 13.759 Long Term Debt Other Long Term Libilities 14.108 22.702 Corro Stock Metadaming Total Equity and Llables 11,562 3.226 650 Common Stock Retained Earnings Total Equity and abilities 19,077 5,123 100,00 ROE 6.62% Company B is more efficiently controlling it's expenses. Company B is earning higher sales relative to its size, Company B is more effectively using debt to leverans its equity. There is not enough information to determine. Questo completion Status Company has earned a higher return on equity than Company A What appears to be driving the higher rati? Company 0 Company A Blance Sheet Income Statement Balance Sheet In Mein Dim 162 Coul of God 14.700 Cash Aceh metry Other Current Total Current Net Sales Cost of Goods Sold Gross Profit Cash Accounts Receivable entory Other Current Assets Total Current Assets 2267 24200 1572 22.029 50.129 151 MI Operpen Operating Expenses Depreciation Operating income 1411 13.575 2007 Net Property. Plantand 1241 Investments Net Property. Plant, and Total Assets 65,503 Non operating income EBIT 422 5.868 Total Assets JOROND 1,183 2.77 16.950 1.622 Interest Expense EBT Als Current Portion Long Term Del Total Current Lates Accounts Payable Accrual Current Portionem Total Current Labs 16.132 27 2.770 100 Income Tours Net Income 715 1770 Long Term Debe Other Long Term Liabilities R$50 13.759 Long Term Debt Other Long Term Libilities 14.108 22.702 Corro Stock Metadaming Total Equity and Llables 11,562 3.226 650 Common Stock Retained Earnings Total Equity and abilities 19,077 5,123 100,00 ROE 6.62% Company B is more efficiently controlling it's expenses. Company B is earning higher sales relative to its size, Company B is more effectively using debt to leverans its equity. There is not enough information to determine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts