Question: quical Thinking Exercises 1. Repeat the exercise from Key Concept Questoms for this chaper ware. Then run the following what-if shoenarios and create graphy monthly

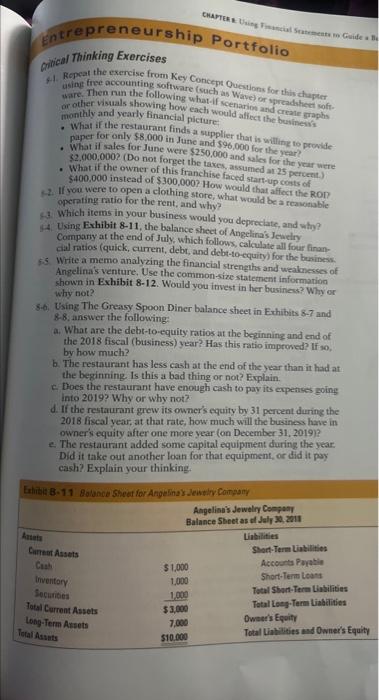

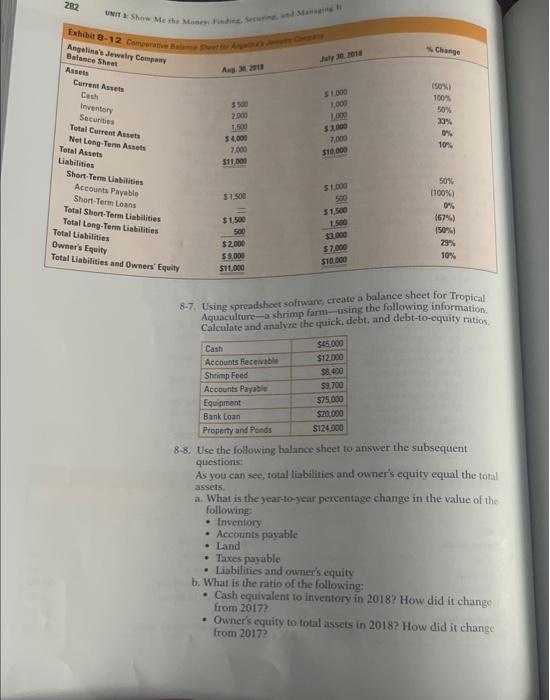

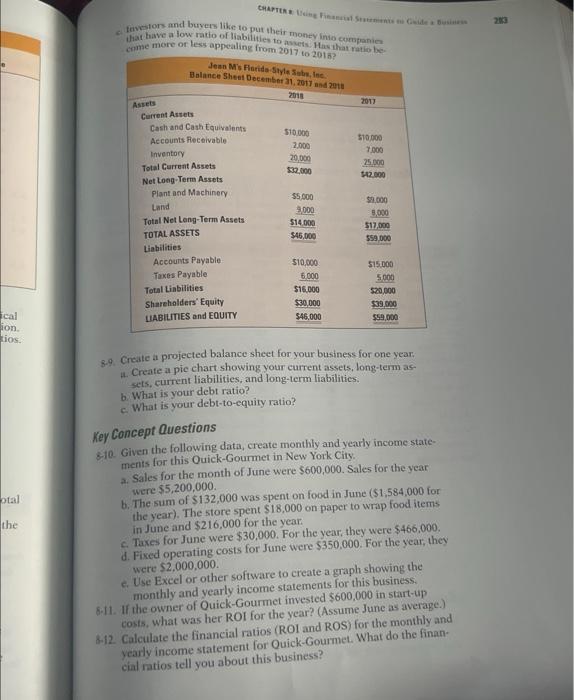

quical Thinking Exercises 1. Repeat the exercise from Key Concept Questoms for this chaper ware. Then run the following what-if shoenarios and create graphy monthly and yearly financial picture - What if the restauraint finds a stipplier that is willine to peovide paper for only $8,000 in June and $96,000 for the year - What if sales for June were \$250,000 and sales for the year were - What if the owner of this franchise facced start-up conts of $400.000 instead of $300,000. How would that affect the ROI? 1.2. If you were to open a clothing store, what would be a reasoitable operating ratio for the rent, and why? 43. Which items in your business would you depreclate, and why? 17. Using Exhibit 8-11, the balance shect of Angelina's Jewelry Compary at the end of July, which follows, calculate all four financial ratios (quick, current, debt, and debt-to-equity) for the bosiness. is Write a memo analyzing the financial strengths and wealenesses of Angelinat's venture, Use the common-size staternent informanion shown in Exhibit 8-12. Would you invest in her busines?? Why or why not? 8.6. Using The Greasy Spoon Diner balance sheet in Exhibits 8-7 and 8-8, answer the following: a. What are the debt-to-equity ratios at the beginning and end of the 2018 fiscal (business) year? Has this ratio impeoved? If of by how much? b. The restaurant has less cash at the end of the year than it had at the beginning. Is this a bad thing or not? Explain. c. Does the restaurant have enough cash to pay its expetses going into 2019? Why or why not? d. If the restaurant grew its owner's equity by 31 percent during the 2018 fiscal year, at that rate, how much will the busineas have in owner's equity after one more year (on December 31, 2019)? e. The restaurant added some capital equipment during the year Did it take out another loan for that equipment, or did it pay 8-7. Using spreadsbect sofrwane, creafe a balance sheet for Tropical Using spreadsbect sofrwac, creafe a balance sheet for Tropicat: Aquaculure-a shamp rarm-asine the followi galete and anatire the quick, debt, and debt-to-cquity ratios 8-8. Use the following balance sheet to answer the subsequent questions: As you can sec, total liabilities and owner's equity equal the total assets a. What is the year-to-year percentage change in the value of the following - Inventory - Accounts piayable - Land - Taxes payable - Liabilities and orener's ciquity b. What is the ratio of the following? - Cash equivalent to inventory in 2018. How did it change from 2017? * Owner's cquity to total assels in 2018 ? How did it change from 2017? tavestors and buyers like to put their money indo curbpanion 8.9. Create a projected balance sheet for your business for one year. H. Create a pie chart showing your current assets, long-term assets, current liabilities, and long-term liabilities. b. What is your debt ratio? c. What is your debt-to-equiry ratio? Ney Concept Questions 30. Given the following data, create monthly and yearly income statemenis for this Quick-Gounmet in New York City. 2. Sales for the month of June were $600,000. Sales for the year were $5,200,000 b. The sum of $132,000 was spent on food in June ( $1,584,000 for the year). The store spent $18,000 on paper to wrap food items in June and $216,000 for the year. c. Taxes for June were $30,000. For the year, they were $466,000. d. Fixed operating costs for June were $350,000. For the year, they c. Use Exeel or other software to create a graph showing the were $2,000,000. monthly and vearly income statements for this business. 8.11. If the owner of Ouick-Gourmet imvested $600,000 in start-up costs, what was her ROI for the year? (Assume June as average.) 4.12. Calculate the financial ratios (ROI and ROS) for the monthly and yearly income statement for Ouick-Gourmet. What do the financial ratios tell you about this business? Show Me the Money: Finding, Securing, and Managing It 8-13. What would the profit before taxes be if the Quick-Gourmet owner found a paper supplier who only charged $200,000 for the year? 8-14. What would the annual profit margin percentage be for QuickGourmet if the paper supplier charged $200,000 rather than 8-15. Suppose the Quick-Gourmet's owner wanted to raise profits by $216,000? $5,000 a month. What would you recommend she do, and why? 8-16. State the financial equation for the balance sheet in three different ways. 8-17. How is depreciation treated on the balance sheet, and what is the logic behind this treatment? quical Thinking Exercises 1. Repeat the exercise from Key Concept Questoms for this chaper ware. Then run the following what-if shoenarios and create graphy monthly and yearly financial picture - What if the restauraint finds a stipplier that is willine to peovide paper for only $8,000 in June and $96,000 for the year - What if sales for June were \$250,000 and sales for the year were - What if the owner of this franchise facced start-up conts of $400.000 instead of $300,000. How would that affect the ROI? 1.2. If you were to open a clothing store, what would be a reasoitable operating ratio for the rent, and why? 43. Which items in your business would you depreclate, and why? 17. Using Exhibit 8-11, the balance shect of Angelina's Jewelry Compary at the end of July, which follows, calculate all four financial ratios (quick, current, debt, and debt-to-equity) for the bosiness. is Write a memo analyzing the financial strengths and wealenesses of Angelinat's venture, Use the common-size staternent informanion shown in Exhibit 8-12. Would you invest in her busines?? Why or why not? 8.6. Using The Greasy Spoon Diner balance sheet in Exhibits 8-7 and 8-8, answer the following: a. What are the debt-to-equity ratios at the beginning and end of the 2018 fiscal (business) year? Has this ratio impeoved? If of by how much? b. The restaurant has less cash at the end of the year than it had at the beginning. Is this a bad thing or not? Explain. c. Does the restaurant have enough cash to pay its expetses going into 2019? Why or why not? d. If the restaurant grew its owner's equity by 31 percent during the 2018 fiscal year, at that rate, how much will the busineas have in owner's equity after one more year (on December 31, 2019)? e. The restaurant added some capital equipment during the year Did it take out another loan for that equipment, or did it pay 8-7. Using spreadsbect sofrwane, creafe a balance sheet for Tropical Using spreadsbect sofrwac, creafe a balance sheet for Tropicat: Aquaculure-a shamp rarm-asine the followi galete and anatire the quick, debt, and debt-to-cquity ratios 8-8. Use the following balance sheet to answer the subsequent questions: As you can sec, total liabilities and owner's equity equal the total assets a. What is the year-to-year percentage change in the value of the following - Inventory - Accounts piayable - Land - Taxes payable - Liabilities and orener's ciquity b. What is the ratio of the following? - Cash equivalent to inventory in 2018. How did it change from 2017? * Owner's cquity to total assels in 2018 ? How did it change from 2017? tavestors and buyers like to put their money indo curbpanion 8.9. Create a projected balance sheet for your business for one year. H. Create a pie chart showing your current assets, long-term assets, current liabilities, and long-term liabilities. b. What is your debt ratio? c. What is your debt-to-equiry ratio? Ney Concept Questions 30. Given the following data, create monthly and yearly income statemenis for this Quick-Gounmet in New York City. 2. Sales for the month of June were $600,000. Sales for the year were $5,200,000 b. The sum of $132,000 was spent on food in June ( $1,584,000 for the year). The store spent $18,000 on paper to wrap food items in June and $216,000 for the year. c. Taxes for June were $30,000. For the year, they were $466,000. d. Fixed operating costs for June were $350,000. For the year, they c. Use Exeel or other software to create a graph showing the were $2,000,000. monthly and vearly income statements for this business. 8.11. If the owner of Ouick-Gourmet imvested $600,000 in start-up costs, what was her ROI for the year? (Assume June as average.) 4.12. Calculate the financial ratios (ROI and ROS) for the monthly and yearly income statement for Ouick-Gourmet. What do the financial ratios tell you about this business? Show Me the Money: Finding, Securing, and Managing It 8-13. What would the profit before taxes be if the Quick-Gourmet owner found a paper supplier who only charged $200,000 for the year? 8-14. What would the annual profit margin percentage be for QuickGourmet if the paper supplier charged $200,000 rather than 8-15. Suppose the Quick-Gourmet's owner wanted to raise profits by $216,000? $5,000 a month. What would you recommend she do, and why? 8-16. State the financial equation for the balance sheet in three different ways. 8-17. How is depreciation treated on the balance sheet, and what is the logic behind this treatment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts