Question: Quick answer pls? Suppose that you are deciding between two different investments for the coming year The first investment is a mutual fund that consists

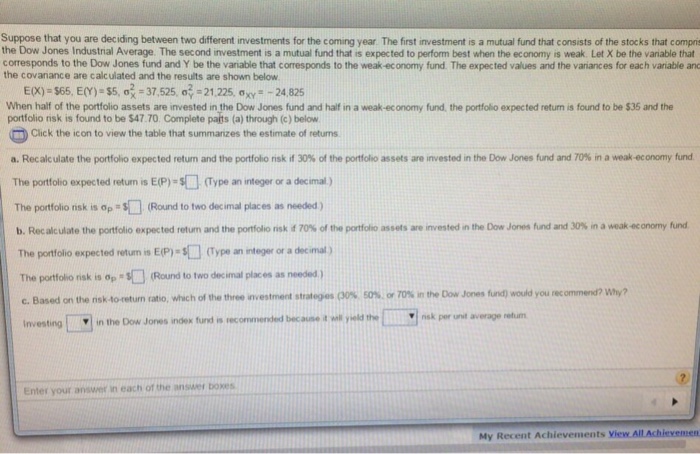

Suppose that you are deciding between two different investments for the coming year The first investment is a mutual fund that consists of the stocks that consists of stocks the Daw Jones Industrial Average The second investment is a mutual fund that is expected to perform best when the economy is weak Let X be the variable that corresponds to the Dow Jones fund and Y be the variable that corresponds to the weak-economy fund The expected values and the variances for each variable anc the covanance are calculated and the results are shown below E(x) = $65.E(Y)$5. sigma = 37.525 sigma =21 225 sigma = - 24 825 When half of the portfolio assets are invested m the Dow Jones fund and half in a weak -economy fund the portfofco expected return is found fo be $35 and the portfolio nsk is found to be $47 70 Complete parts (a) through (c) below Click the icon to view the table that summarizes the estimate of return Recalculate the portfolio expected return and the portfolio risk if 30% o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts