Question: quick answer plz Question No: 3 (Total marks for question 15,5 each for part 'a''b'and c') As an investor you were given to task to

quick answer plz

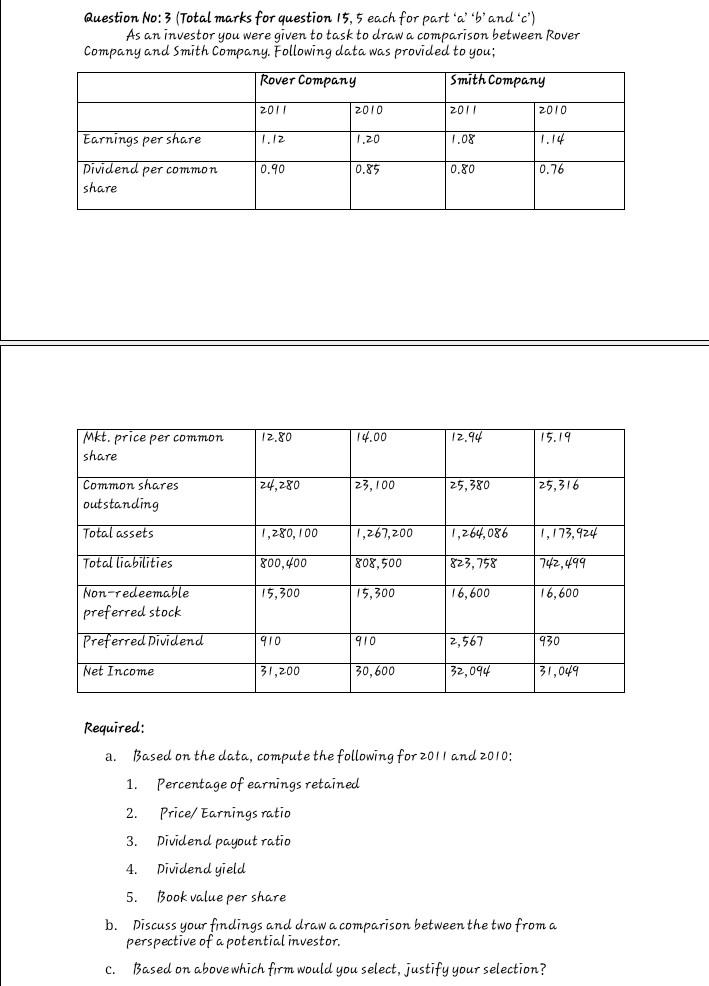

Question No: 3 (Total marks for question 15,5 each for part 'a''b'and c') As an investor you were given to task to draw a comparison between Rover Company and Smith Company. Following data was provided to you; Rover Company Smith Company 2011 2010 2011 2010 Earnings per share 1.12 1.20 1.08 1.14 0.90 0.85 0.80 0.76 Dividend per common share 12.80 14.00 12.94 15.19 Mkt. price per common share 24,280 23,100 25,380 25,316 Common shares outstanding Total assets 1,280,100 1.267,200 1,264,086 1,173,424 Total liabilities 800,400 808,500 823.758 742,499 15,300 15,300 16,600 16,600 Non-redeemable preferred stock Preferred Dividend 910 910 2,567 930 Net Income 31,200 30.600 32,094 31,049 a. Required: Based on the data, compute the following for 2011 and 2010: 1. Percentage of earnings retained 2. Price/ Earnings ratio 3. Dividend payout ratio 4. Dividend yield 5. Book value per share b. Discuss your findings and draw a comparison between the two from a perspective of a potential investor. C. Based on above which firm would you select, justify your selection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts