Question: Quick Copy purchased a new copy machine. The new machine cost $ 1 2 8 , 0 0 0 including installation. The company estimates the

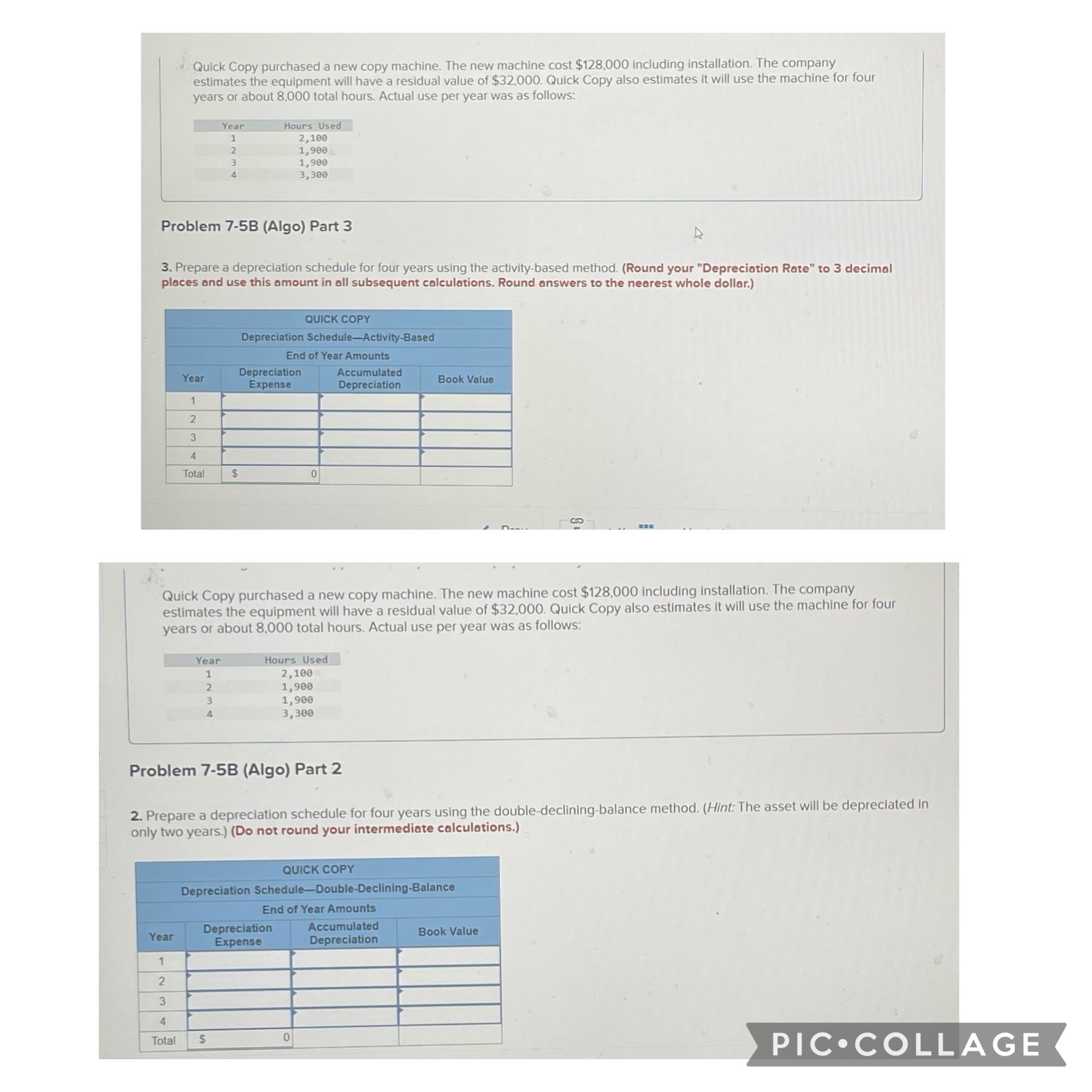

Quick Copy purchased a new copy machine. The new machine cost $ including installation. The company estimates the equipment will have a residual value of $ Quick Copy also estimates it will use the machine for four years or about total hours. Actual use per year was as follows:

tableYearHours Used

Problem B Algo Part

Prepare a depreciation schedule for four years using the activitybased method. Round your "Depreciation Rate" to decimal places and use this amount in all subsequent calculations. Round answers to the nearest whole dollar.

tableQUICK COPYDepreciation ScheduleActivityBasedEnd of Year AmountsYeartableDepreciationExpensetableAccumulatedDepreciationBook ValueTotal$

Quick Copy purchased a new copy machine. The new machine cost $ including installation. The company estimates the equipment will have a residual value of $ Quick Copy also estimates it will use the machine for four years or about total hours. Actual use per year was as follows:

tableYearHours Used

Problem B Algo Part

Prepare a depreciation schedule for four years using the doubledecliningbalance method. Hint: The asset will be depreciated in only two years.Do not round your intermediate calculations.

tableQUICK COPYtableDepreciationEnd of Year AmountsYeartableDepreciationExpensetableAccumulatedDepreciationBook ValueTotal$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock