Question: quick D Question 6 1 pts Use this information for the next 3 questions. Currently you own 1.840 common shares of a company. The company

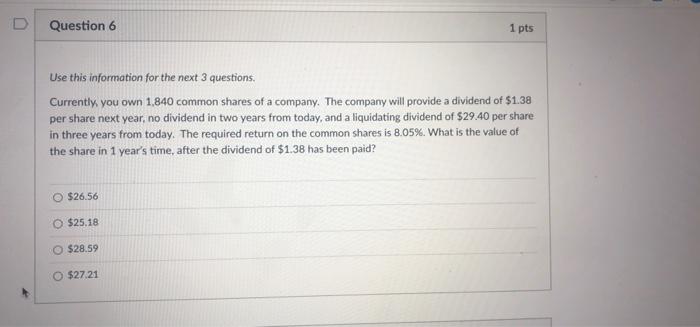

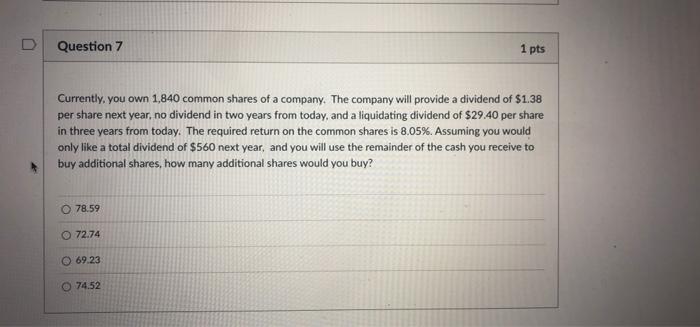

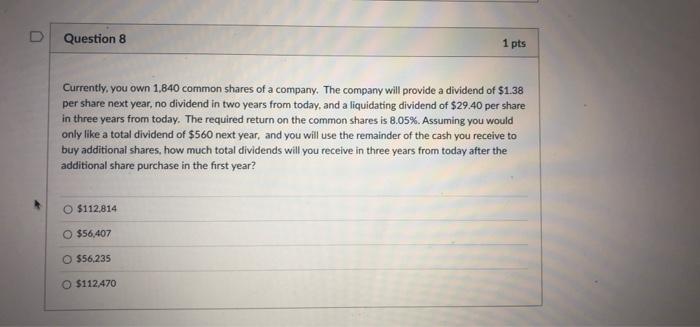

D Question 6 1 pts Use this information for the next 3 questions. Currently you own 1.840 common shares of a company. The company will provide a dividend of $1.38 per share next year, no dividend in two years from today, and a liquidating dividend of $29.40 per share in three years from today. The required return on the common shares is 8.05%. What is the value of the share in 1 year's time, after the dividend of $1.38 has been paid? O $26.56 $25.18 $28.59 O $27.21 U Question 7 1 pts Currently, you own 1,840 common shares of a company. The company will provide a dividend of $1.38 per share next year, no dividend in two years from today, and a liquidating dividend of $29.40 per share in three years from today. The required return on the common shares is 8.05%. Assuming you would only like a total dividend of $560 next year, and you will use the remainder of the cash you receive to buy additional shares, how many additional shares would you buy? 78.59 O 72.74 69.23 74.52 D Question 8 1 pts Currently, you own 1.840 common shares of a company. The company will provide a dividend of $1.38 per share next year, no dividend in two years from today, and a liquidating dividend of $29.40 per share in three years from today. The required return on the common shares is 8.05%. Assuming you would only like a total dividend of $560 next year, and you will use the remainder of the cash you receive to buy additional shares, how much total dividends will you receive in three years from today after the additional share purchase in the first year? O $112.814 O $56,407 $56.235 $112.470

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts