Question: quick help plz~ 12 points LQ2 (12 points, 3 points for each subquestion) Clear Corporation manufactures and sells products and uses standard costing. Actual data

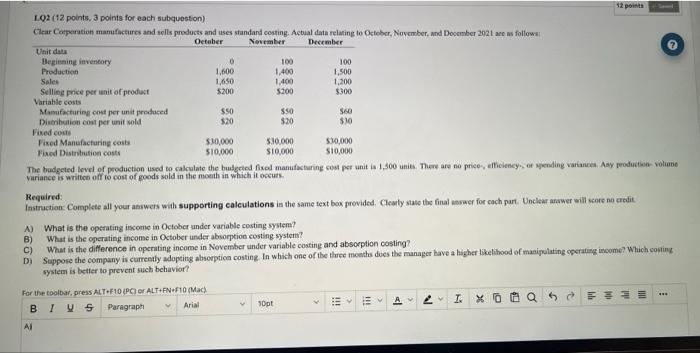

12 points LQ2 (12 points, 3 points for each subquestion) Clear Corporation manufactures and sells products and uses standard costing. Actual data relating to October, November, and December 2021 are as follows: October November December Unit data Beginning inventory 0 100 Production 100 1,400 1,600 1,500 Sales 1,650 1,400 1,200 Selling price per unit of product $200 $200 $300 Variable costs Manufacturing cost per unit produced $50 $50 $60 Distribution cost per unit sold $20 $20 $30 Fixed costs Fixed Manufacturing costs $30,000 $30,000 $10,000 $30,000 $10,000 Fixed Distribution costs $10,000 The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 1,500 units. There are no price, efficiency, or spending variances. Any production volume variance is written off to cost of goods sold in the month in which it occurs. Required: Instruction: Complete all your answers with supporting calculations in the same text box provided. Clearly state the final answer for cach part. Unclear answer will score no credit. A) What is the operating income in October under variable costing system? B) What is the operating income in October under absorption costing system? C) What is the difference in operating income in November under variable costing and absorption costing? D) Suppose the company is currently adopting absorption costing. In which one of the three months does the manager have a higher likelihood of manipulating operating income? Which costing system is better to prevent such behavior? For the toolbar, press ALT+F10 (PC) or ALT+FN-F10 (Mac) w Y AV EEV Arial BIVS QFEE 2 IX 0 10pt Paragraph Al

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts