Question: quick please and must be accurate... Use given Marginal rate table to compute Federal Income Tax (5pts). Round to the nearest cent. a. Single female,

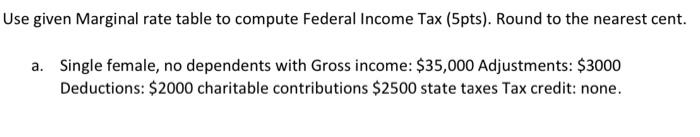

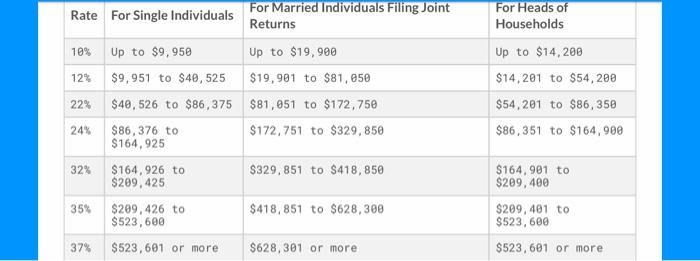

Use given Marginal rate table to compute Federal Income Tax (5pts). Round to the nearest cent. a. Single female, no dependents with Gross income: $35,000 Adjustments: $3000 Deductions: $2000 charitable contributions $2500 state taxes Tax credit: none. Rate For Single Individuals For Married Individuals Filing Joint Returns 10% Up to $9,950 Up to $19,900 12% $9,951 to $40,525 $19,901 to $81,050 22% $40,526 to $86,375 $81,051 to $172,750 24% $ 86,376 to $172,751 to $329,850 $164,925 32% $164,926 to $329,851 to $418,850 $209,425 35% $209,426 to $418,851 to $628,300 $523,600 For Heads of Households Up to $14,200 $14,201 to $54,200 $54,201 to $86,350 $86,351 to $164,900 $164,901 to $209,400 $209,401 to $523,600 $523,601 or more 37% $523, 601 or more $628,301 or more

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts