Question: QUICK QUESTION - PLEASE ANSWER BY 3:30PM EST IF POSSIBLE (in 30 mins) I WILL THUMBS UP FOR CORRECT ANSWER! Where did they get the

QUICK QUESTION - PLEASE ANSWER BY 3:30PM EST IF POSSIBLE (in 30 mins) I WILL THUMBS UP FOR CORRECT ANSWER!

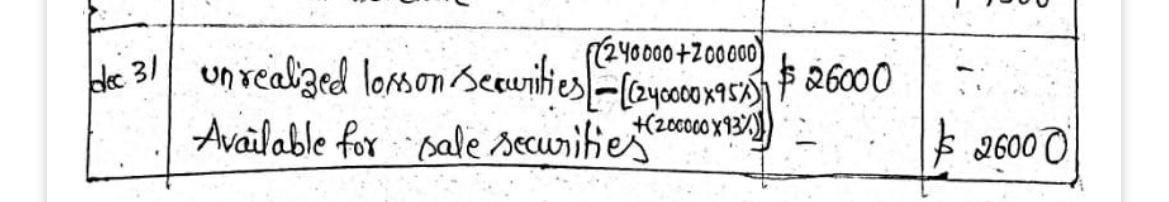

Where did they get the $240,000 when calculating the unrealized loss on securities (pictures provided below)

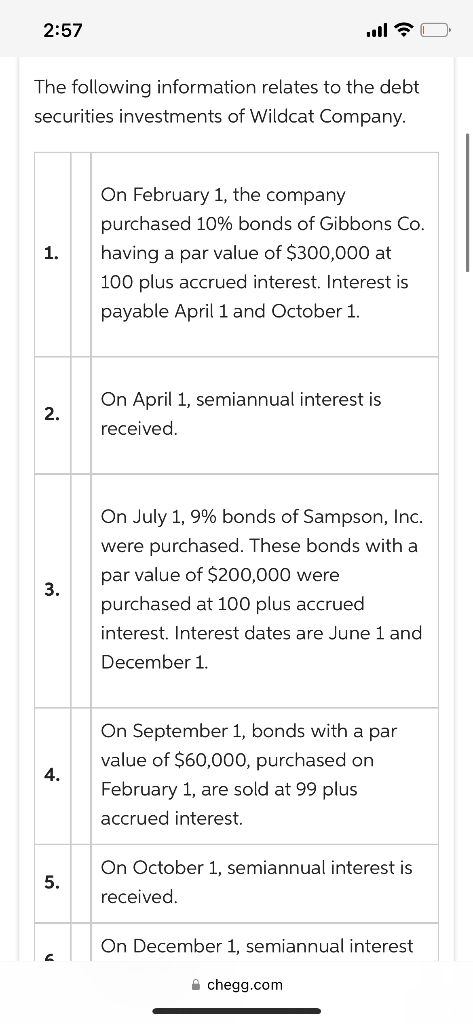

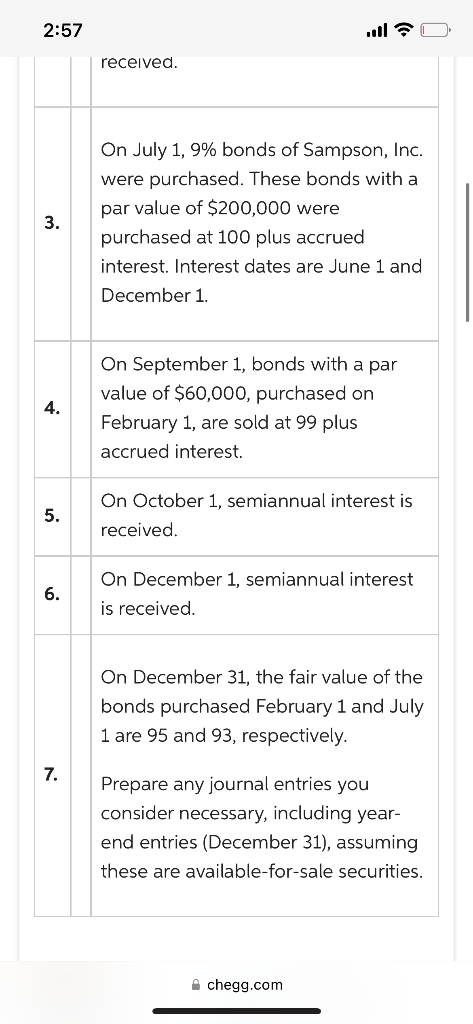

2:57 ,oll The following information relates to the debt securities investments of Wildcat Company. On February 1 , the company purchased 10% bonds of Gibbons Co. 1. having a par value of $300,000 at 100 plus accrued interest. Interest is payable April 1 and October 1. 2. On April 1, semiannual interest is received. On July 1, 9\% bonds of Sampson, Inc. were purchased. These bonds with a par value of $200,000 were purchased at 100 plus accrued interest. Interest dates are June 1 and December 1. On September 1 , bonds with a par 4. value of $60,000, purchased on February 1 , are sold at 99 plus accrued interest. 5. On October 1 , semiannual interest is received. On December 1 , semiannual interest chegg.com 2:57 received. On July 1, 9\% bonds of Sampson, Inc. were purchased. These bonds with a par value of $200,000 were purchased at 100 plus accrued interest. Interest dates are June 1 and December 1. On September 1 , bonds with a par 4. value of $60,000, purchased on February 1 , are sold at 99 plus accrued interest. 5. On October 1 , semiannual interest is received. 6. On December 1 , semiannual interest is received. On December 31 , the fair value of the bonds purchased February 1 and July 1 are 95 and 93 , respectively. 7. Prepare any journal entries you consider necessary, including yearend entries (December 31), assuming these are available-for-sale securities. chegg.com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts