Question: Quick Share Ltd . ( QSL ) , a Sydney - based IT firm that specialises in providing video sharing services, has a market value

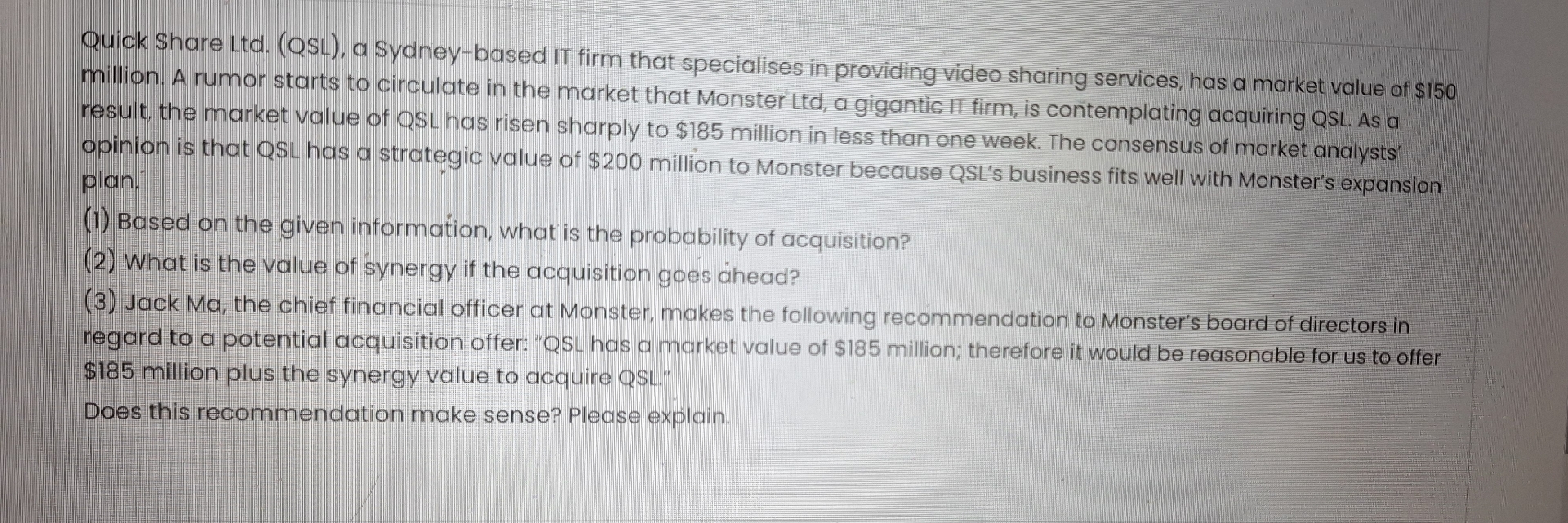

Quick Share LtdQSL a Sydneybased IT firm that specialises in providing video sharing services, has a market value of $ million. A rumor starts to circulate in the market that Monster Ltd a gigantic II firm, is contemplating acquiring QSL As a result, the market value of QSL has risen sharply to $ million in less than one week. The consensus of market analysts opinion is that QSL has a strategic value of $ million to Monster because QSLs business fits well with Monster's expansion plan.

Based on the given information, what is the probability of acquisition?

What is the value of synergy if the acquisition goes ahead?

Jack Ma the chief financial officer at Monster, makes the following recommendation to Monster's board of directors in regard to a potential acquisition offer: QSL has a market value of $ million; therefore it would be reasonable for us to offer $ million plus the synergy value to acquire QSL

Does this recommendation make sense? Please explain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock