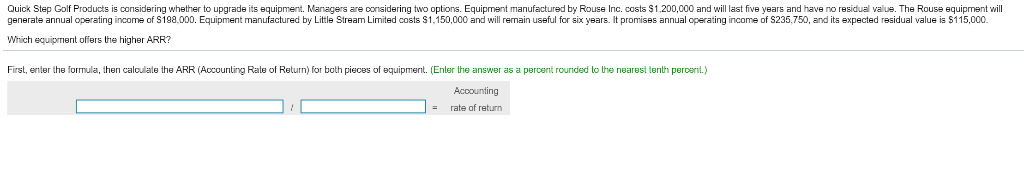

Question: Quick Step Golf Products is considering whether to upgrade its equipment. Managers are oonsidering two options. Equipment manufactured by Rouse Irnc. costs $1,200,000 and will

Quick Step Golf Products is considering whether to upgrade its equipment. Managers are oonsidering two options. Equipment manufactured by Rouse Irnc. costs $1,200,000 and will last five years and have no residual value. The Rouse equipment will generate annual operating income af S198.000. Equipment manufactured by Little Stream Limited costs $1,150,000 and will remain useful for six years. It promises annual operating income o $115,000 Litle isers Which equipment ofiers the higher ARR? $235,750, and its expected residual value is equiprrie First, enier the formula, then calculate the ARR (Accouriting Rate of Return) for both pieces of equipmert. ( Enter the answer as a percent rounded to the neares tenth peroent.) Accounting - rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts