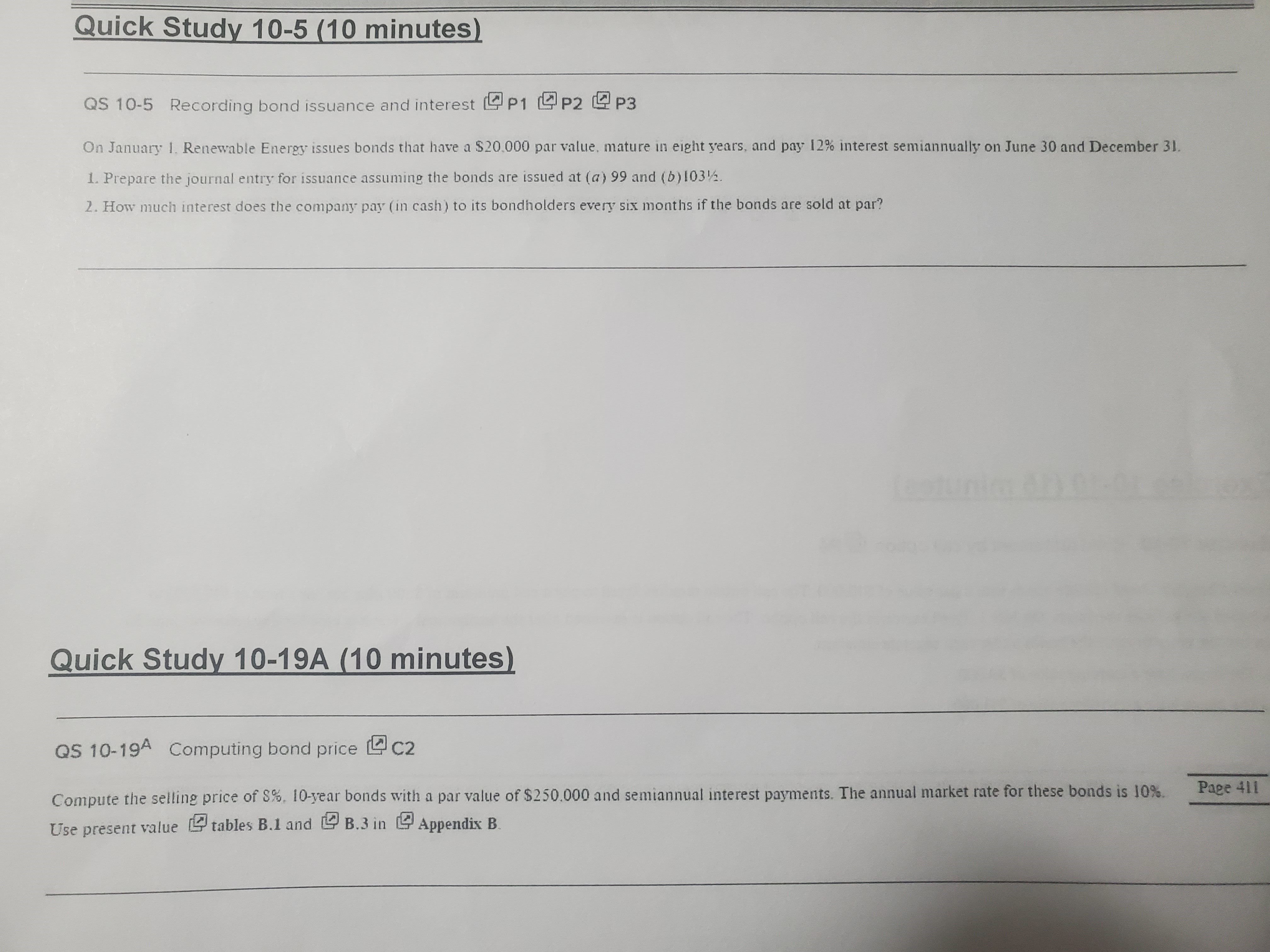

Question: Quick Study 1 0 - 5 ( 1 0 minutes ) Q S 1 0 - 5 Recording bond issuance and interest ? ? ?

Quick Study minutes

Recording bond issuance and interest

January Renewable Energy issues bonds that have $ par value, mature eight years, and pay interest semiannually June and December

Prepare the journal entry for issuance assuming the bonds are issued and

How much interest does the company pay cash its bondholders every six months the bonds are sold par?

Quick Study minutes

Computing bond price

Compute the selling price $vear bonds with a par value $ and semiannual interest payments. The annual market rate for these bonds

Use present value tables and Appendix

Problem A Straight Line: Amortization bond premium

Refer the bond details Problem except assume that the bonds are issued a price $ life.

Check

Prepare the first two years a straightline amortization table like Exhibit

: carying vilue $

Prepare the journal entries record the first two interest payments. A Computing bond price

Compute the selting price year bonds with a par value $ and semiannual interest payments. The annual market rate for these bonds Use present

value tables and Appendix

Exercise minutes

Exercise Bond retirement call option

Tyrell Company issued callable bonds with a par value $ The call option requires Tyrell pay a call premium $$ $

The bonds have a carrying value $ Problem A StraightLine: Amortization bond discount

Hillside issues $year bonds dated Janusry that pay interest semignnully June and December The bonds are issued a price

$

Required

Prepare the January journal entry record the bonds issuance.

For each semignnual period, compute the cash payment, the straightline discount emortization, and the bond interest expense.

Determine the total bond interest expense recognized over the bonds life.

carryng value $

Prepare the first two years a straightline amortization table like

Exhibit

Prepare the journal entries record the first two interest payments.Exercise minutes

Exercise Recording bond issuance and interest

January Boston Enterprises issues bonds that have $ par value, mature years, and pay

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock