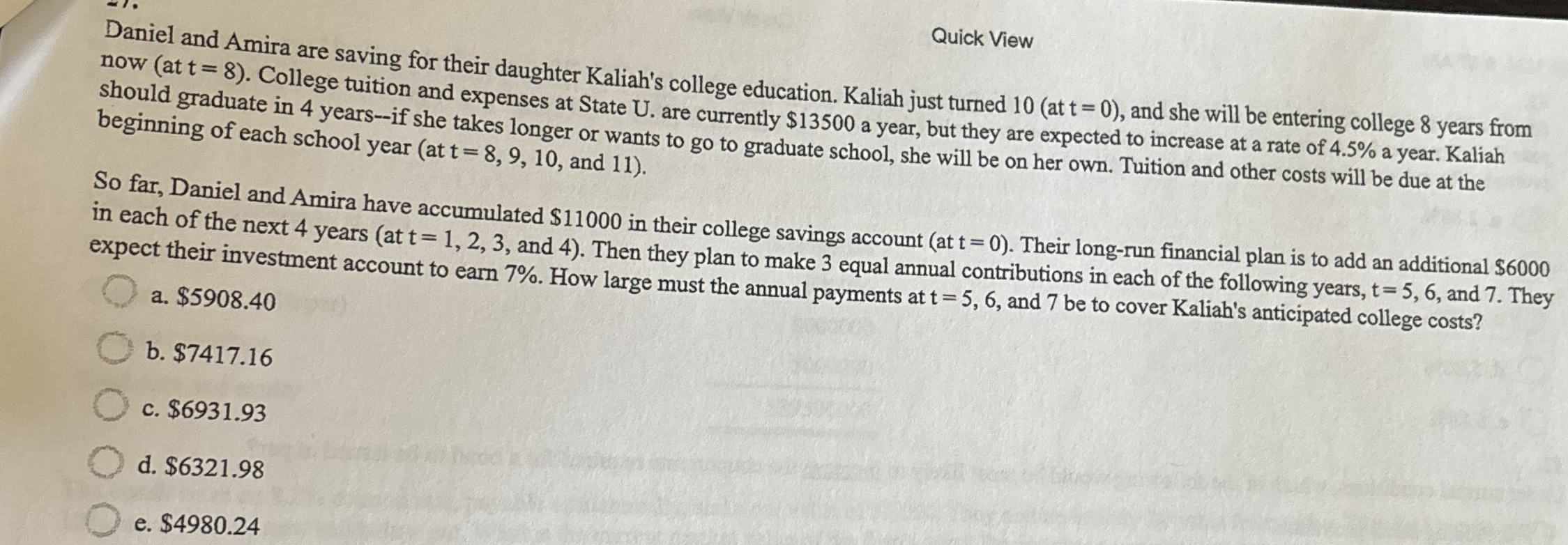

Question: Quick View now ( at t = 8 ) . College tuition and expenses at State U . are currently $ 1 3 5 0

Quick View

now at College tuition and expenses at State U are currently $ a year, but they are expected to increase at a rate of a year. Kaliah

should graduate in yearsif she takes longer or wants to go to graduate school, she will be on her own. Tuition and other costs will be due at the

beginning of ea school year at and

So far, Daniel and Amira have accumulated $ in their college savings account at Their longrun financial plan is to add an additional $

in each of the next years at and Then they plan to make equal annual contributions in each of the following years, and They

expect their investment account to earn How large must the annual payments at and be to cover Kaliah's anticipated college costs?

a $

b $

c $

d $

e $

Quick View

now at College tuition and expenses at State U are currently $ a year, but they are expected to increase at a rate of a year. Kaliah

should graduate in yearsif she takes longer or wants to go to graduate school, she will be on her own. Tuition and other costs will be due at the

beginning of ea school year at and

So far, Daniel and Amira have accumulated $ in their college savings account at Their longrun financial plan is to add an additional $

in each of the next years at and Then they plan to make equal annual contributions in each of the following years, and They

expect their investment account to earn How large must the annual payments at and be to cover Kaliah's anticipated college costs?

a $

b $

c $

d $

e $

Quick View

now at College tuition and expenses at State U are currently $ a year, but they are expected to increase at a rate of a year. Kaliah

should graduate in yearsif she takes longer or wants to go to graduate school, she will be on her own. Tuition and other costs will be due at the

beginning of ea school year at and

So far, Daniel and Amira have accumulated $ in their college savings account at Their longrun financial plan is to add an additional $

in each of the next years at and Then they plan to make equal annual contributions in each of the following years, and They

expect their investment account to earn How large must the annual payments at and be to cover Kaliah's anticipated college costs?

a $

b $

c $

d $

e $

Quick View

now at College tuition and expenses at State U are currently $ a year, but they are expected to increase at a rate of a year. Kaliah

should graduate in yearsif she takes longer or wants to go to graduate school, she will be on her own. Tuition and other costs will be due at the

beginning of ea school year at and

So far, Daniel and Amira have accumulated $ in their college savings account at Their longrun financial plan is to add an additional $

in each of the next years at and Then they plan to make equal annual contributions in each of the following y

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock