Question: QuickBooks question You are preparing the log for auto expense deduction at year end. Your client has been using the QuickBooks Mileage tracker throughout the

QuickBooks question

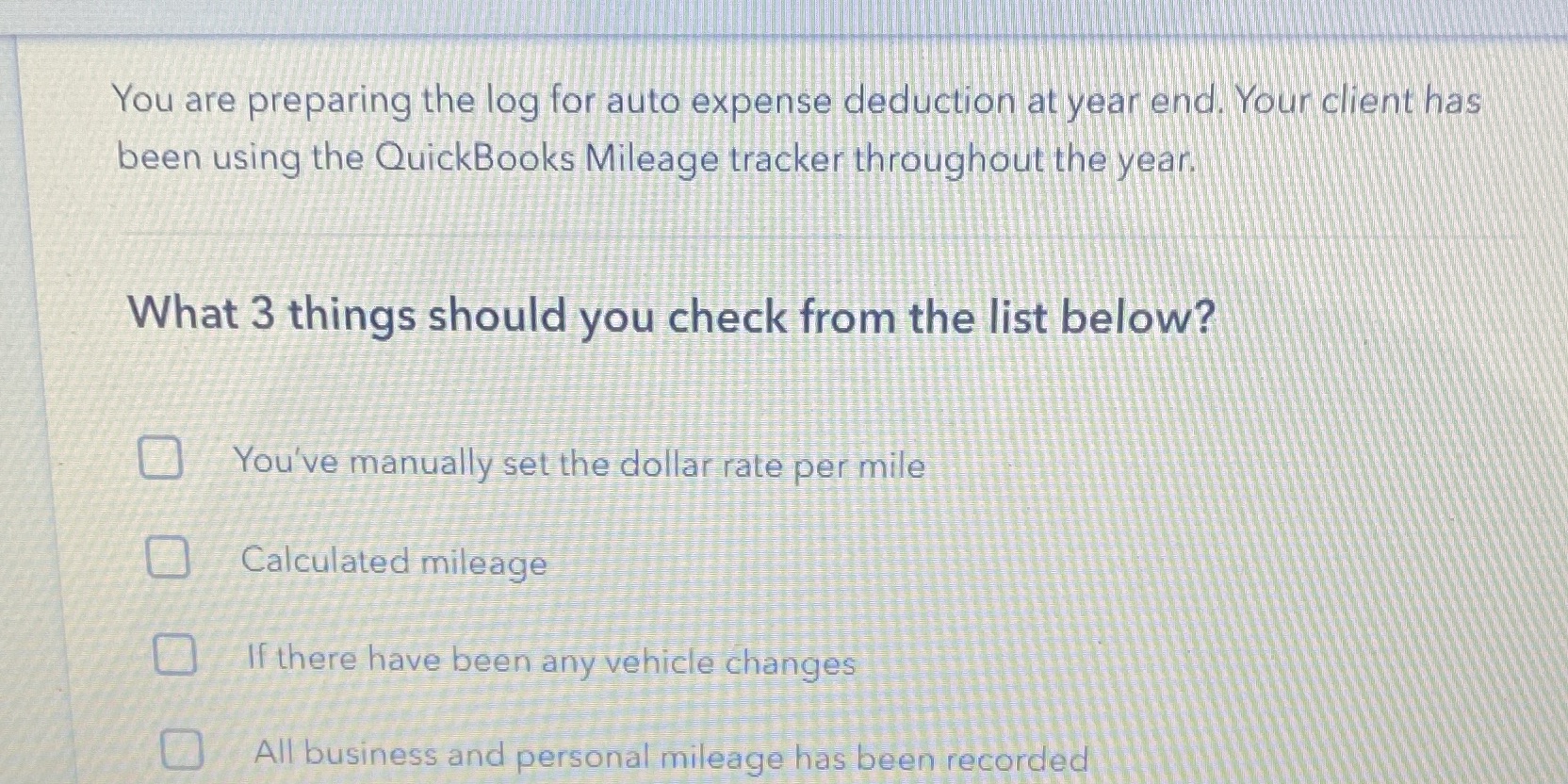

You are preparing the log for auto expense deduction at year end. Your client has been using the QuickBooks Mileage tracker throughout the year. What 3 things should you check from the list below? You've manually set the dollar rate per mile Calculated mileage If there have been any vehicle changes All business and personal mileage has been recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts