Question: quickly please i will give you a straight like .. Intel is considering making a new investment of $ 1000 in a new chip producing

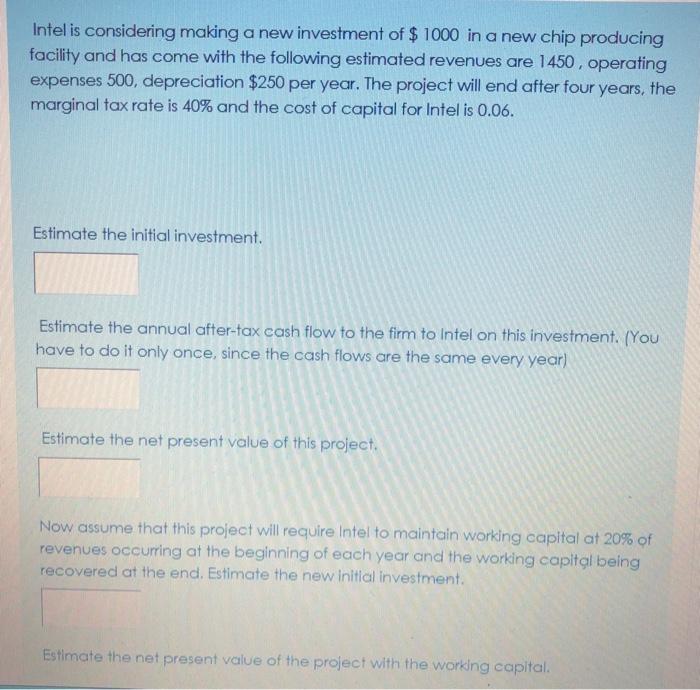

Intel is considering making a new investment of $ 1000 in a new chip producing facility and has come with the following estimated revenues are 1450, operating expenses 500, depreciation $250 per year. The project will end after four years, the marginal tax rate is 40% and the cost of capital for Intel is 0.06. Estimate the initial investment. Estimate the annual after-tax cash flow to the firm to Intel on this investment. (You have to do it only once, since the cash flows are the same every year) Estimate the net present value of this project. Now assume that this project will require Intel to maintain working capital at 20% of revenues occurring at the beginning of each year and the working capital being recovered at the end. Estimate the new initial investment. Estimate the net present value of the project with the working capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts