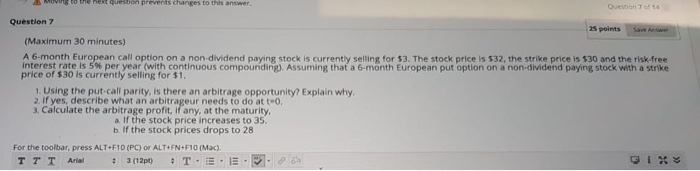

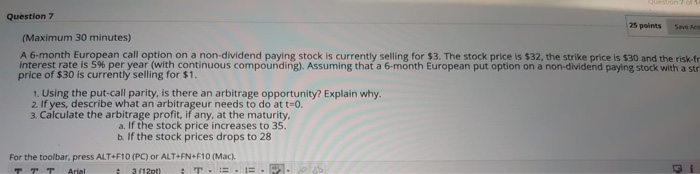

Question: quickly please!!!! moving to the next question prevents changes to this answer Quono Question 7 25 points (Maximum 30 minutes) A 6-month European call option

moving to the next question prevents changes to this answer Quono Question 7 25 points (Maximum 30 minutes) A 6-month European call option on a non-dividend paying stock is currently selling for 53. The stock price is $32, the strike price is $30 and the risk free Interest rate is 5% per year with continuous compounding). Assuming that a 6-month European put option on a non-dividend paying stock with a strike price of $30 is currently selling for $1. 1. Using the put call parity, is there an arbitrage opportunity? Explain why, 2. If yes, describe what an arbitrageur needs to do atto. 3. Calculate the arbitrage profit, if any, at the maturity, a. If the stock price increases to 35. b. If the stock prices drops to 28 For the toolbar, press ALT+F10(PC) or ALT+FN+F10 (Mac). Aria 3 (12pt] + T.. E 2011 Question 7 25 points (Maximum 30 minutes) A 6-month European call option on a non-dividend paying stock is currently selling for $3. The stock price is $32, the strike price is $30 and the risk.fr interest rate is 5% per year (with continuous compounding). Assuming that a 6-month European put option on a non-dividend paying stock with a str price of $30 is currently selling for $1. 1. Using the put-call parity, is there an arbitrage opportunity? Explain why. 2 If yes, describe what an arbitrageur needs to do at t=0. 3. Calculate the arbitrage profit, if any, at the maturity. a. If the stock price increases to 35. b. If the stock prices drops to 28 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). TTT Arial 3 (12 - T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts