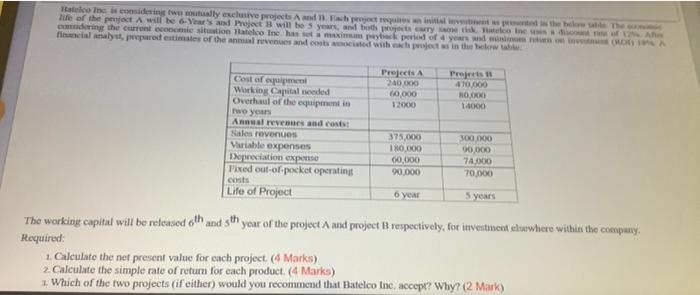

Question: Quickly pleease ! Batelco Inc. is considering two mutually exclusive projects A and 11. Each project requires an initial investment as presented is the below

Batelco Inc. is considering two mutually exclusive projects A and 11. Each project requires an initial investment as presented is the below table The co life of the project A will be 6-Year's and Project B will be 5 years, and both projects carry same tisk. Batelco the use considering the current economic situation atelco Inc. has set a maximam payback period of 4 years and minimums turn on inved (RD) 19 A financial analyst, prepared estimates of the annual revenues and costs associated with each project as in the below tabl discount re of 12%. After Projects A 240,000 Cost of equipment Working Capital needed Overhaul of the equipment in Projects I 470,000 80,000 60,000 12000 14000 two years Annual revenues and costs: Sales revenues 375,000 300,000 Variable expenses 180,000 90,000 Depreciation expense 60,000 74,000 Fixed out-of-pocket operating 90,000 70,000 costs Life of Project 6 year 5 years The working capital will be released 6th and 5th year of the project A and project B respectively, for investment elsewhere within the company. Required: 1. Calculate the net present value for each project. (4 Marks) 2. Calculate the simple rate of return for each product. (4 Marks) 1. Which of the two projects (if either) would you recommend that Batelco Inc. accept? Why? (2 Mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts