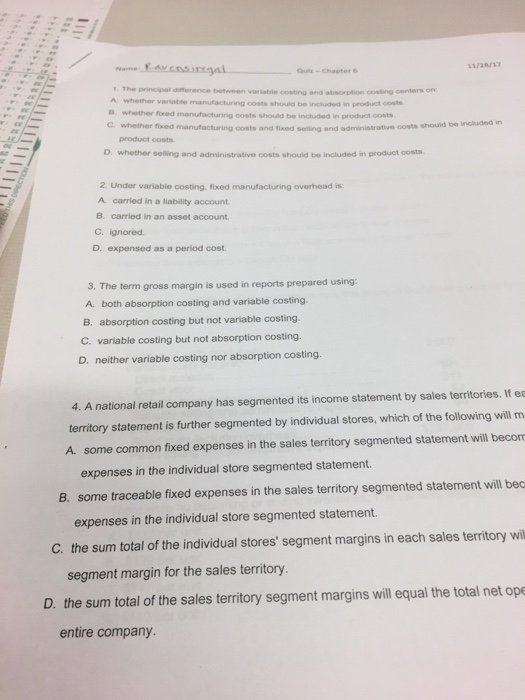

Question: Quir- Chapter . The between variable costing and absorption costing centers on whether variable manufacturing costs should be included in product costs B whether f

Quir- Chapter . The between variable costing and absorption costing centers on whether variable manufacturing costs should be included in product costs B whether f C whether ixed manufacturing costs should be included in product costs fixed manufacturing costs and fixed selling and administrative costa selling and administrative costs shold be included in product costs D. whether selling and administrative costs should be included in product costs 2 Under variable costing, fixed manufacturing overhead is A carried in a liability account B. carried in an asset account C. ignored D. expensed as a period cost. 3. The term gross margin is used in reports prepared using: A both absorption costing and variable costing. B. absorption costing but not variable costing. C. variable costing but not absorption costing. D. neither variable costing nor absorption costing. 4. A national retail company has segmented its income statement by sales territories. If ea territory statement is further segmented by individual stores, which of the following will m A. some common fixed expenses in the sales territory segmented statement will becon expenses in the individual store segmented statement. B. some traceable fixed expenses in the sales territory segmented statement will bec expenses in the individual store segmented statement. C. the sum total of the individual stores' segment margins in each sales territory wi segment margin for the sales territory D. the sum total of the sales territory segment margins will equal the total net op entire company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts