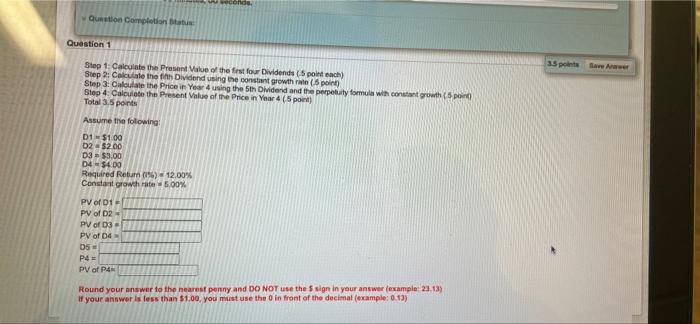

Question: Quito Completion Question 1 35 point flere Step 1: Calculate the present Value of the first four Dividendo point each) Step 2: Calculate the Dividend

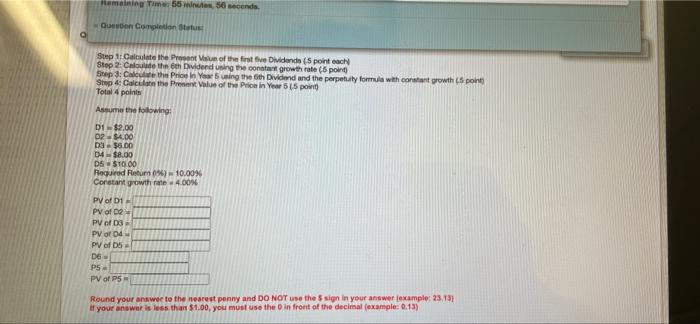

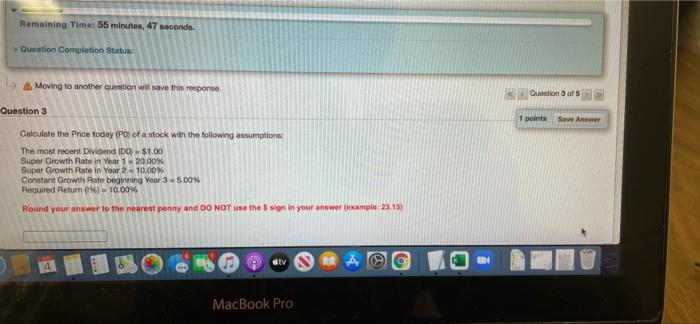

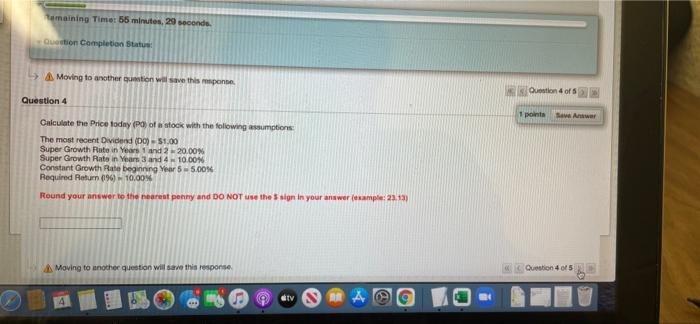

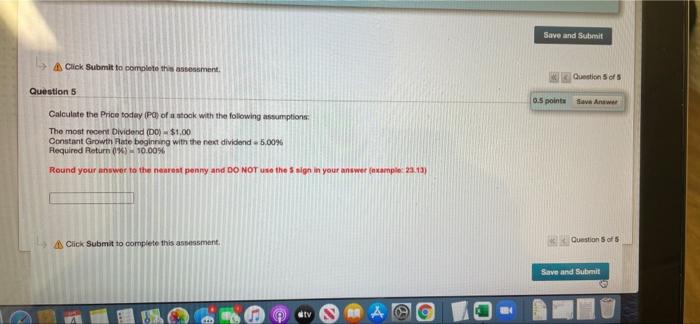

Quito Completion Question 1 35 point flere Step 1: Calculate the present Value of the first four Dividendo point each) Step 2: Calculate the Dividend using the constant growth rate (point Step 3: Calolate the price in Yeard using the stern Dividend and the perpetuity formula with constant growth sporo Step 4: Calculate the present Value of the Price in Your 45 point) Total 3.5 ports Assume the following D1 $100 D2 - $2.00 03 $3.00 04 $4.00 Required Return (196) 12.00% Constant growth rate 5.00% PV of 01 PV of 2 PV of 3 Py of 4 05 P4 PV of P4 Round your answer to the nearest penny and DO NOT use the sign in your answer fecample: 2113) If your answer is less than $1.00, you must use the in front of the decimal (example: 0.13) emaining Time 66 minutes, 50 cenda Queen Completion tus Step 1: Calculate the present Value of the first five Dividends (5 points Step 2:Colouate the oth Dividend using the constant growth rate (6 point) Step 3: Calculate the Price In Your using the oth Dividend and the perpetuity formula with constant growth 5 point Step 4: Calculate the rest Value of the Price in Year 55 point Total 4 points Assume the following: 01 $2.00 D254.00 Da $5.00 04 $8.00 D5 $10.00 Required Retums) 10.00% Constant growth rate 4.00% PV of 1 PV of D2 PV of D3 PV od PV of D5 06 PS PV of PS Round your answer to the nearest penny and DO NOT use the sign in your answer example: 23.73) if your answer is less than $1.00, you must use the in front of the decimal example: 0.13) Remaining Time: 55 minutes, 47 secondo Question Completion Status A Moving to another question will save this response Question 3 of 5 Question 3 1 points Save Answer Calculate the Price today (PO) of a stock with the following assumptions The most recent Dividend (DO) = $1.00 Super Growth Rate in Year 1 20.00% Super Growth Rate in Your 2 - 10.00% Constant Growth Rale beginning Year 3 = 5.00% Required Return (%) = 10.00% Round your answer to the nearest penny and DO NOT use the sign in your answer example: 23.13) sty A MacBook Pro Tamaining Time 56 minutes, 29 seconds Quction Completion Status > Moving to another ton will save this monte Oution of Question 4 1 points Calculate the price today (POof stock with the following assumptions: The most recent Dividend (0) $1.00 Super Growth Patein Years 1 and 220.00 Super Growth rate in Year 3 and 410.00% Constant Growth Rate beginning Year 55.00% Required Return (96) 10,00 Round your answer to the nearest penny and DO NOT Use the sign in your answer ample: 23.13) Moving to another question will save this response Question 4045 TV Save and Submit Click Submit to complete this assessment Question of Question 5 0.5 points Have Anw. Calculate the Price today pay of stock with the following assumptions The most recent Dividend (DO) - $1.00 Constant Growth rate beginning with the next dividend - 5.00% Required Return (X) - 10.00% Round your answer to the nearest penny and DO NOT use the sign in your answer intample 23.13) 5 Click Submit to complete this assessment Questions of Save and Submit RR A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts