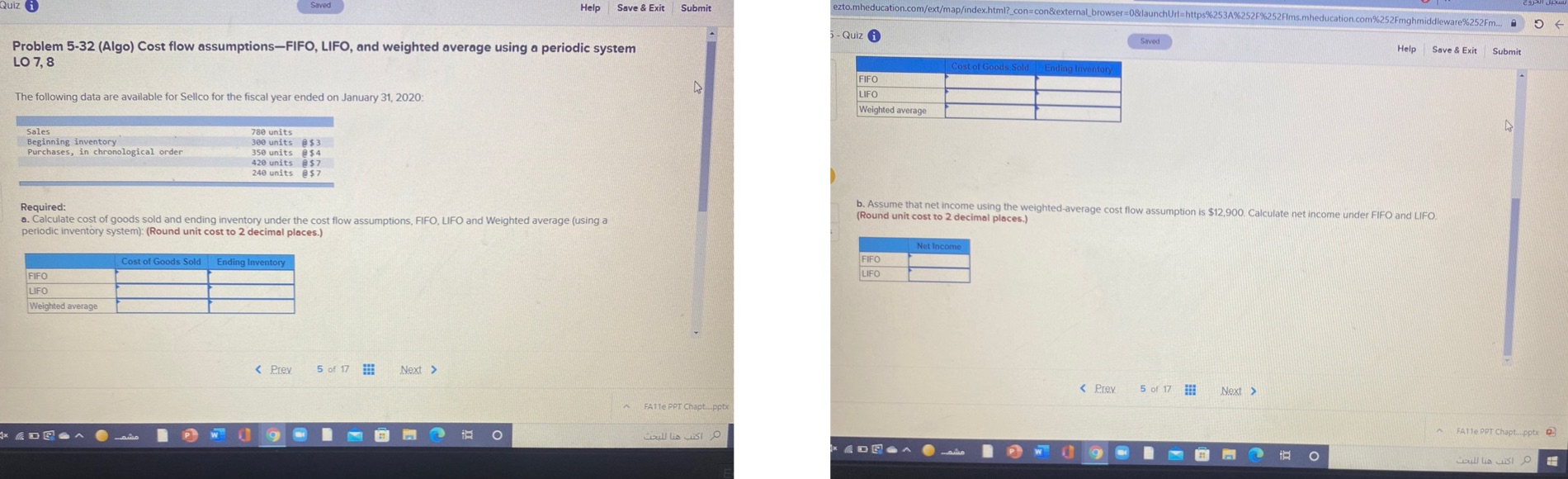

Question: Quiz i Saved Help Save & Exit Submit ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fims.mheducation.com%252Fmghmiddleware%252Fm... # - Quiz i Saved Help Save & Exit Submit Problem 5-32 (Algo) Cost flow assumptions-FIFO,

Quiz i Saved Help Save & Exit Submit ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fims.mheducation.com%252Fmghmiddleware%252Fm... # - Quiz i Saved Help Save & Exit Submit Problem 5-32 (Algo) Cost flow assumptions-FIFO, LIFO, and weighted average using a periodic system LO 7, 8 FIFO LIFO The following data are available for Sellco for the fiscal year ended on January 31, 2020: Weighted average Sales 780 units Beginning inventory 360 units @ $3 Purchases, in chronological order 350 units @$4 420 units @$7 240 units @$7 b. Assume that net income using the weighted-average cost flow assumption is $12,900. Calculate net income under FIFO and LIFO Required: (Round unit cost to 2 decimal places.) . Calculate cost of goods sold and ending inventory under the cost flow assumptions, FIFO, LIFO and Weighted average (using a periodic inventory system): (Round unit cost to 2 decimal places.) Net Income FIFO Cost of Goods Sold Ending Inventory LIFO FIFO LIFO Weighted average FATTe PPT Chapt_pptx FAT le PPT Chapt_.pptx Q: O Call lis Just O P W L 9 C BO O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts