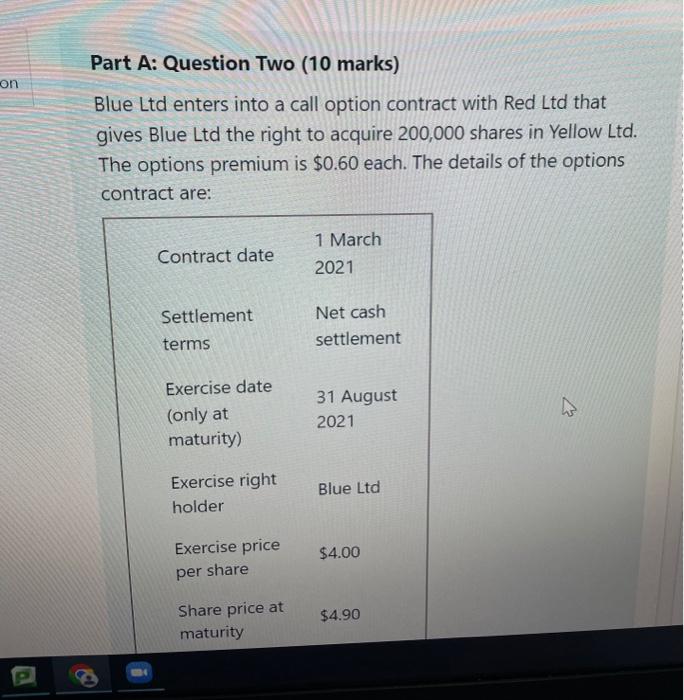

Question: quiz on Part A: Question Two (10 marks) Blue Ltd enters into a call option contract with Red Ltd that gives Blue Ltd the right

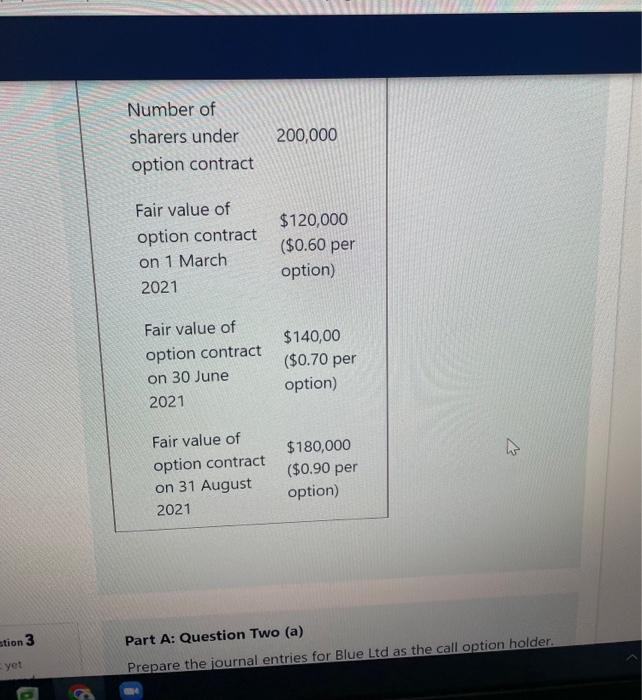

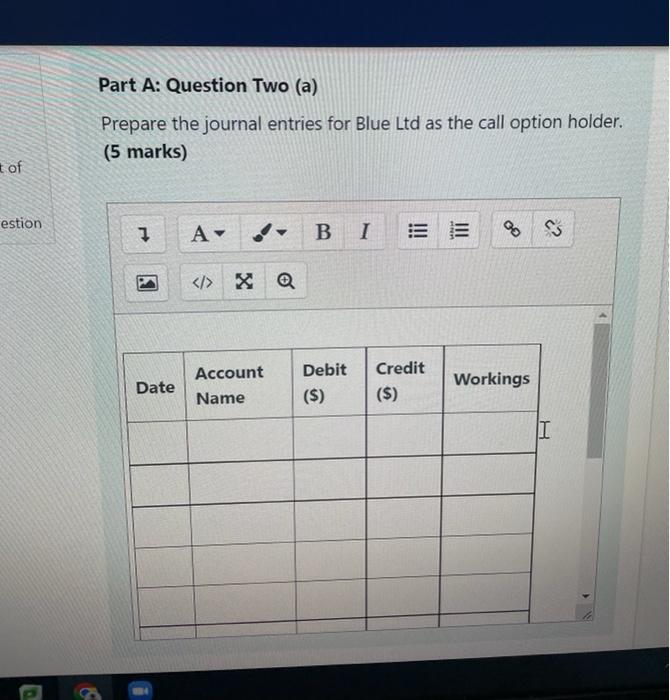

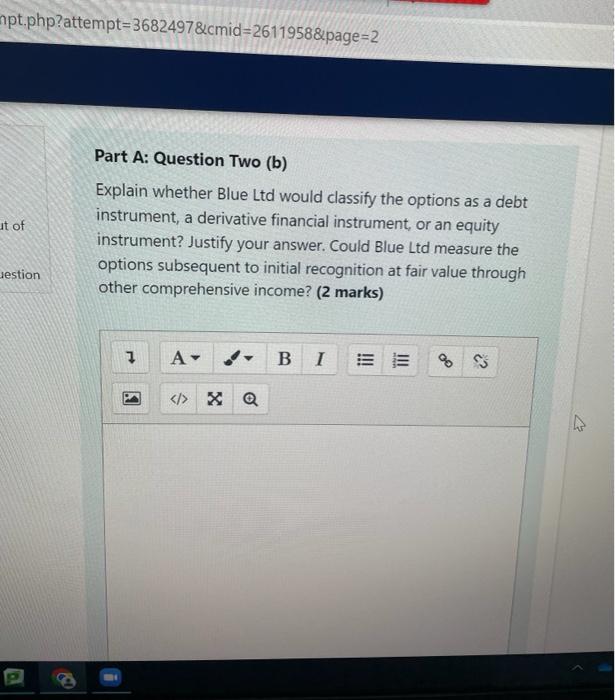

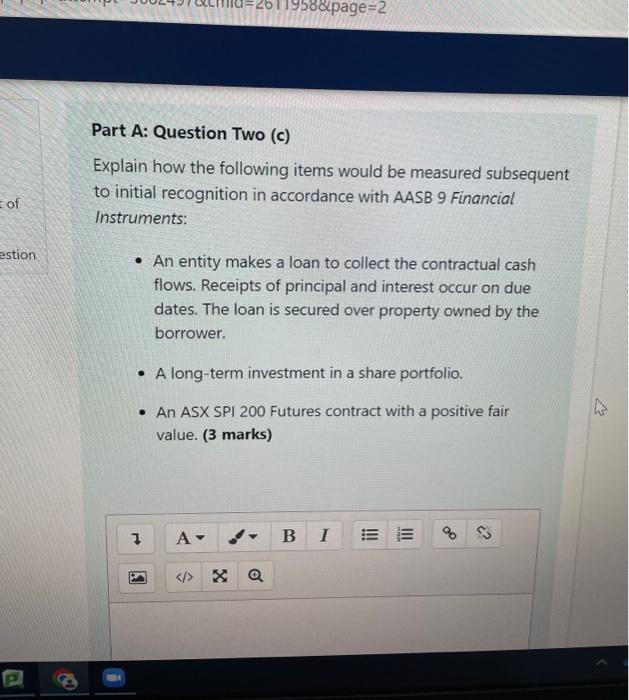

on Part A: Question Two (10 marks) Blue Ltd enters into a call option contract with Red Ltd that gives Blue Ltd the right to acquire 200,000 shares in Yellow Ltd. The options premium is $0.60 each. The details of the options contract are: Contract date 1 March 2021 Settlement Net cash terms settlement Exercise date 31 August (only at 2021 maturity) Exercise right Blue Ltd holder Exercise price $4.00 per share Share price at $4.90 maturity stion 3 yet Number of sharers under option contract Fair value of option contract on 1 March 2021 Fair value of option contract on 30 June 2021 Fair value of option contract on 31 August 2021 Part A: Question Two (a) Prepare the journal entries for Blue Ltd as the call option holder. 200,000 $120,000 ($0.60 per option) $140,00 ($0.70 per option) $180,000 ($0.90 per option) t of estion Part A: Question Two (a) Prepare the journal entries for Blue Ltd as the call option holder. (5 marks) 1 A BI EE % X Q Account Credit Workings Name ($) Date Debit ($) 2? I mpt.php?attempt=3682497&cmid=2611958&page=2 Part A: Question Two (b) Explain whether Blue Ltd would classify the options as a debt instrument, a derivative financial instrument, or an equity instrument? Justify your answer. Could Blue Ltd measure the options subsequent to initial recognition at fair value through other comprehensive income? (2 marks) 1 A B I EE 8 83 X Q ut of uestion C = of estion P 1958&page=2 Part A: Question Two (c) Explain how the following items would be measured subsequent to initial recognition in accordance with AASB 9 Financial Instruments: . An entity makes a loan to collect the contractual cash flows. Receipts of principal and interest occur on due dates. The loan is secured over property owned by the borrower. A long-term investment in a share portfolio. An ASX SPI 200 Futures contract with a positive fair value. (3 marks) 1 A B I EE X Q A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts