Question: Qwest Inc, an Ottawa - based company, enjoys a steady demand for stainless steel infiltrators used in a number of chemical processes. Revenues from the

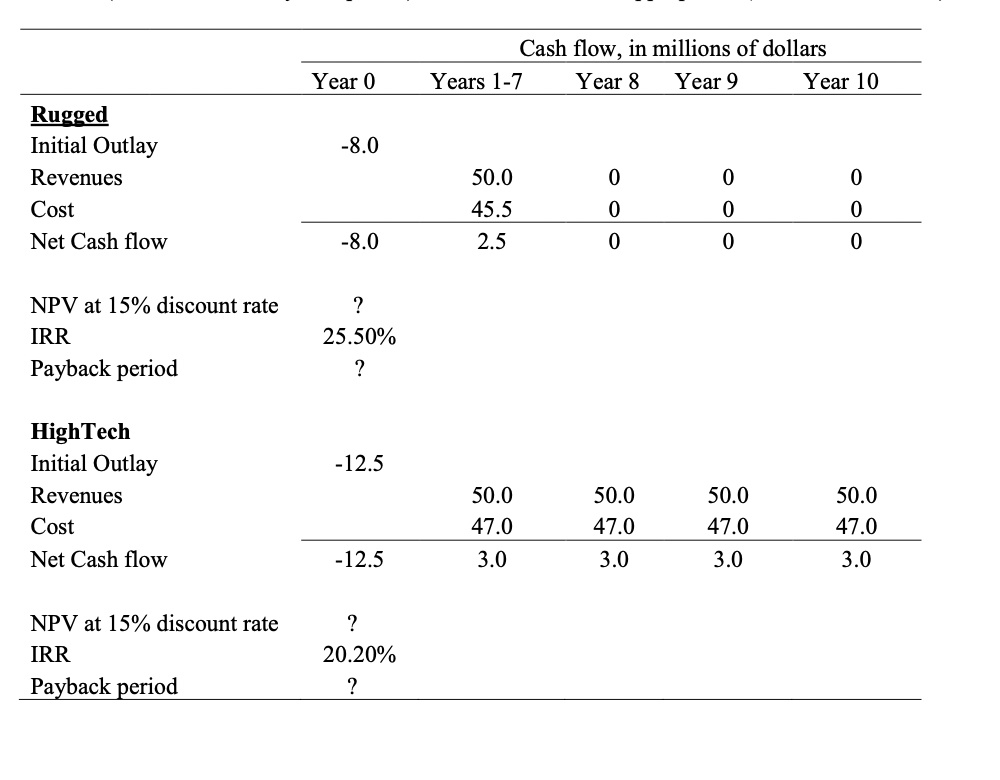

Qwest Inc, an Ottawabased company, enjoys a steady demand for stainless steel infiltrators used in a number of chemical processes. Revenues from the infiltrator division are $ million a year and production costs are $ million, generating net cash flows of $ million. However, the high precision Rugged stamping machines used in the production process are coming to the end of their useful life. One possibility being considered by the company is simply to replace each existing machine with a new Rugged. These machines will cost $ each and would not involve any additional operating costs. The alternative is to buy centrally controlled HighTech stampers. HighTechs cost $ million each, but unlike the Rugged they would produce a total savings in operating and material costs of $ a year. Moreover, the HighTech is sturdily built and would last years, as against an estimated year life for the Rugged. Analysts in the infiltrator division have produced the summary table shown below, which shows the forecast total cash flows from the infiltrator business over the life of each machine. Qwests standard procedures for appraising capital investments involve calculating net presentvalue, internal rate of return, and payback period, and some of these measures are shown in the table. As usual, Melissa Kock arrived early at Qwests head office. She had never regretted joining Qwest. Everything about the place, from the narrow windows to the bell fountain in the atrium, suggested a classy outfit. Ms Kock sighed happily and reached for the envelop at the top of her intray. It was an analysis from the infiltrator division of the replacement options for the stamper machines. Pinned to the paper was the summary table of cash flows shown below and a note from the Vice President of the company, which read, Melissa I have read through pages of detailed analysis, and I still dont know which of the machines we should buy. Looking at the numbers, I suspect the NPV calculation would indicate that the HighTech is best, while the IRR and payback probably suggest the opposite. Would you take a look, then estimate the NPV and payback period, and tell me which one we should buy and why You are required to help Ms Kock by writing a memo to the Vice President. You need to justify your recommendation by i constructing a spreadsheet or using any tools, eg formulas, time value of money tables, etc. to estimate the NPV using a discount rate of and the payback period for the projects, and ii explain why some or all of the project analysis techniques listed in the table ie NPV IRR, Payback period and their values are inappropriate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock