Question: QZ Appendix D Saved Help Save & Exit Submit Required information [The following information applies to the questions displayed below.) Part 1 of 2 On

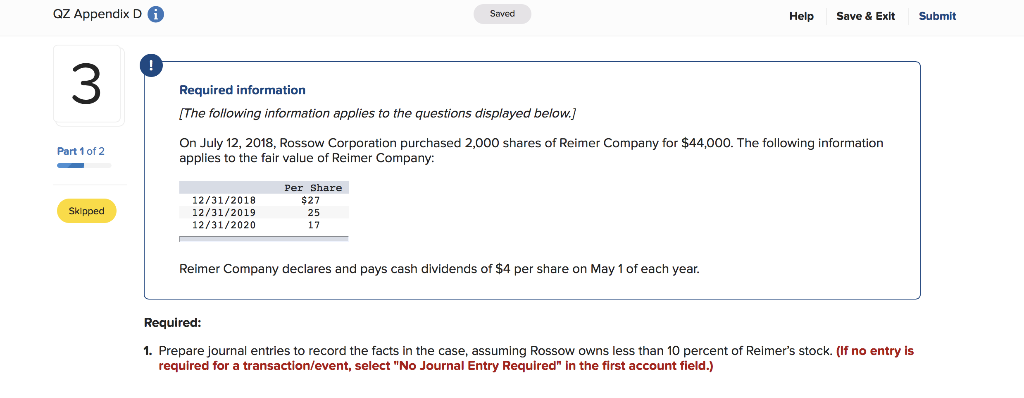

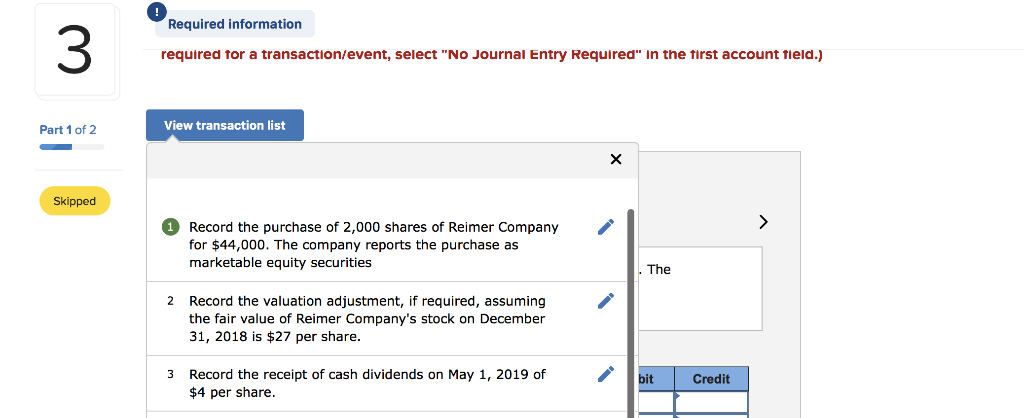

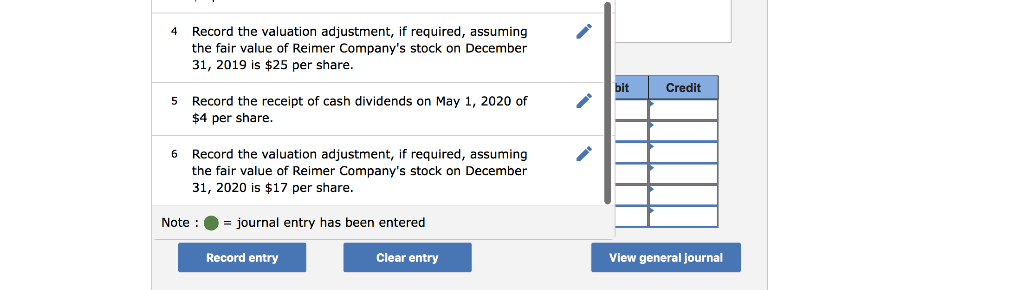

QZ Appendix D Saved Help Save & Exit Submit Required information [The following information applies to the questions displayed below.) Part 1 of 2 On July 12, 2018, Rossow Corporation purchased 2,000 shares of Reimer Company for $44,000. The following information applies to the fair value of Reimer Company: Per Share $27 25 12/31/2018 12/31/2019 12/31/2020 Skipped 17 Reimer Company declares and pays cash dividends of $4 per share on May 1 of each year. Required: 1. Prepare journal entries to record the facts in the case, assuming Rossow owns less than 10 percent of Reimer's stock. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Required information required for a transaction/event, select "No Journal Entry Required" in the first account field.) Part 1 of 2 View transaction list Skipped Record the purchase of 2,000 shares of Reimer Company for $44,000. The company reports the purchase as marketable equity securities . The 2 Record the valuation adjustment, if required, assuming the fair value of Reimer Company's stock on December 31, 2018 is $27 per share. 3 Record the receipt of cash dividends on May 1, 2019 of $4 per share. bit Credit 4 Record the valuation adjustment, if required, assuming the fair value of Reimer Company's stock on December 31, 2019 is $25 per share. bit Credit 5 Record the receipt of cash dividends on May 1, 2020 of $4 per share. 6 Record the valuation adjustment, if required, assuming the fair value of Reimer Company's stock on December 31, 2020 is $17 per share. Note : = journal entry has been entered Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts