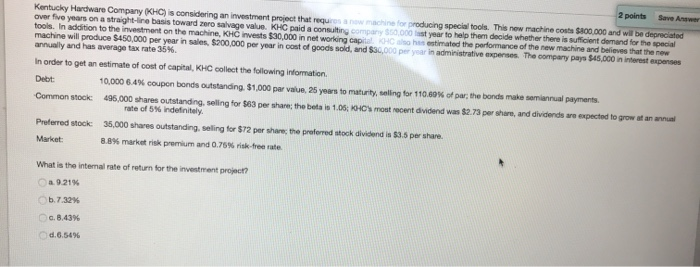

Question: r 2 points Save Answer oducing special tools. This new machine costs NO.000 and will be depreciated year to help the decide whether there is

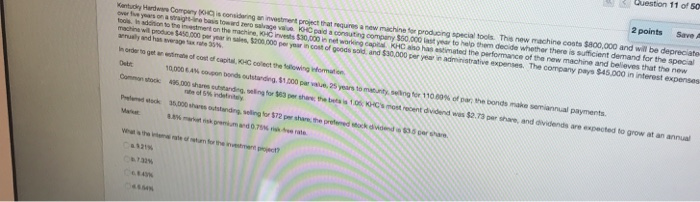

r 2 points Save Answer oducing special tools. This new machine costs NO.000 and will be depreciated year to help the decide whether there is sufficient demand for the special a stimated the performance of the new machine and believes that the new in administrative expenses. The company pays $45,000 in interest expenses Kentucky Hardware Company (KHC) is considering an investment project that require ap over five years on a straight- basis towardro salvage value KHC paid a const a n tools. In addition to the investment on the machine, KH inwests $30,000 in networking capil machine will produce $450,000 per year in wes, $200.000 per year in cost of goods sold, and annually and has average tax rate 35%. t In order to get an estimate of cost of capital, KHC collect the following information Debt: 10.000 6.4% coupon bonds outstanding. $1,000 par value, 25 years to maturity, saling for 110.60% of pur, the bonds make manual payments. Common stock 495,000 shares outstanding, seling for $63 per share the beta is 105: most recent dividend was $2.73 per share, and dividends are expected to grow at an annual rate of 5indefinitely Preferred stock 35,000 shares outstanding, seling for $72 per share the preferred stock dividend is 53.5 per share Market 8.8% market risk premium and 0.75% risk-free rate What is the internal rate of return for the investment project? a 9.21 6.7.32 0.8.43 06.54 Question 11 of 50 Vand Hard wereysong Company is considering an investment project that runs a new machine for producing special tools This new machine costs $800.000 and will be depreciate o nsdotte ines toward Pero salvage valve machine e t on the machine, K 1450.000 per year in a and has wretex paid a conting company 550.000 ines $30.000 net wag 2 points Save $200.000 per year in cost of goods horder to get year to help the decide whether there is sufficient derand for the special KHC has started the performance of the new machine and believes that the new and $50,000 per year in administrative expenses. The company pays $45.000 in interest expenses state of cost of capital, Ch 10,000 EAN c e Commons hook lowing Hormation on bords outstanding, $1 36.000 share use 0 p , 25 years to maturity, sering for 11000% of ling for Pred lock ndrey per share the best 6.000 s s tanding, og for $72 pe share the prete the bonds make semiannual payments o nt dividend was $2.73 per share, and dividends are expected to grow at an annual 8.% marked red stock e and 32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts