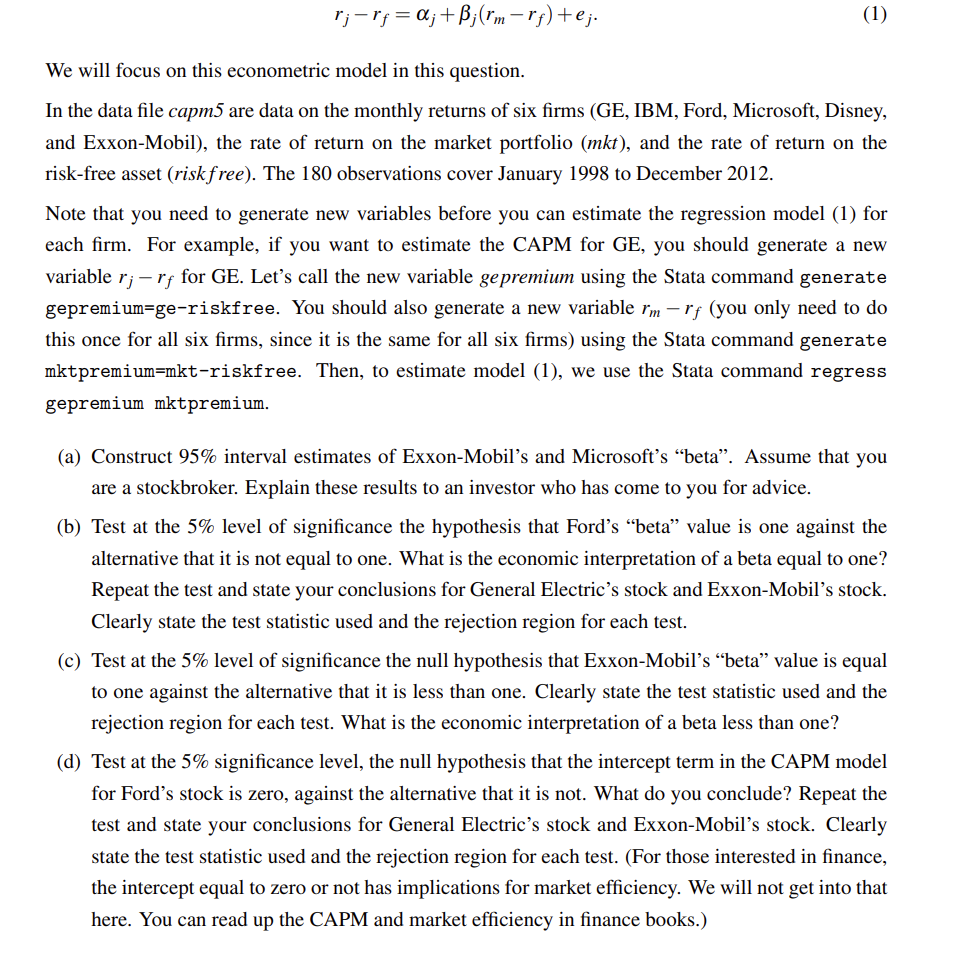

Question: r j - r f = j + j ( r m - r f ) + e j We will focus on this econometric

We will focus on this econometric model in this question.

In the data file capm are data on the monthly returns of six firms GE IBM, Ford, Microsoft, Disney,

and ExxonMobil the rate of return on the market portfolio and the rate of return on the

riskfree asset riskfree The observations cover January to December

Note that you need to generate new variables before you can estimate the regression model for

each firm. For example, if you want to estimate the CAPM for GE you should generate a new

variable for GE Let's call the new variable gepremium using the Stata command generate

gepremiumgeriskfree. You should also generate a new variable you only need to do

this once for all six firms, since it is the same for all six firms using the Stata command generate

mktpremiummktriskfree. Then, to estimate model we use the Stata command regress

gepremium mktpremium.

a Construct interval estimates of ExxonMobil's and Microsoft's "beta". Assume that you

are a stockbroker. Explain these results to an investor who has come to you for advice.

b Test at the level of significance the hypothesis that Ford's "beta" value is one against the

alternative that it is not equal to one. What is the economic interpretation of a beta equal to one?

Repeat the test and state your conclusions for General Electric's stock and ExxonMobil's stock.

Clearly state the test statistic used and the rejection region for each test.

c Test at the level of significance the null hypothesis that ExxonMobil's "beta" value is equal

to one against the alternative that it is less than one. Clearly state the test statistic used and the

rejection region for each test. What is the economic interpretation of a beta less than one?

d Test at the significance level, the null hypothesis that the intercept term in the CAPM model

for Ford's stock is zero, against the alternative that it is not. What do you conclude? Repeat the

test and state your conclusions for General Electric's stock and ExxonMobil's stock. Clearly

state the test statistic used and the rejection region for each test. For those interested in finance,

the intercept equal to zero or not has implications for market efficiency. We will not get into that

here. You can read up the CAPM and market efficiency in finance books.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock