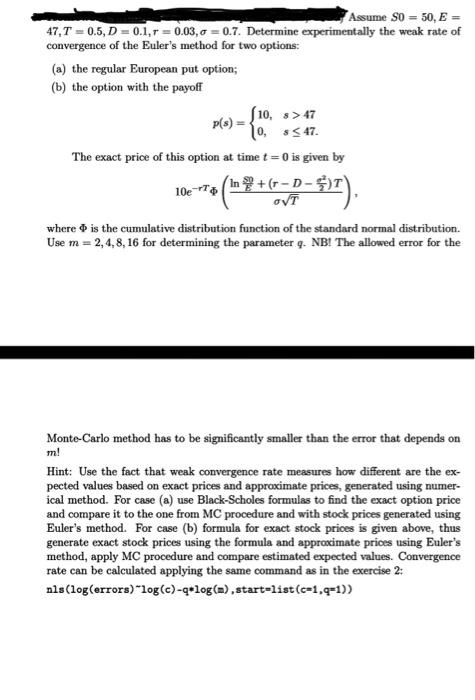

Question: R studio solution only Assume S0 = 50, E- 47, T =0.5, D = 0.1, r=0.03,0 = 0.7. Determine experimentally the weak rate of convergence

Assume S0 = 50, E- 47, T =0.5, D = 0.1, r=0.03,0 = 0.7. Determine experimentally the weak rate of convergence of the Euler's method for two options: (a) the regular European put option; (b) the option with the payoff 10, > 47 10,347 The exact price of this option at time t=0 is given by 10e - 75 In + (r-D-$T p(s) = $7). avf where is the cumulative distribution function of the standard normal distribution Use m = 2,4,8, 16 for determining the parameter . NB! The allowed error for the Monte-Carlo method has to be significantly smaller than the error that depends on m! Hint: Use the fact that weak convergence rate measures how different are the ex- pected values based on exact prices and approximate prices, generated using numer- ical method. For case (a) use Black-Scholes formulas to find the exact option price and compare it to the one from MC procedure and with stock prices generated using Euler's method. For case (b) formula for exact stock prices is given above, thus generate exact stock prices using the formula and approximate prices using Euler's method, apply MC procedure and compare estimated expected values. Convergence rate can be calculated applying the same command as in the exercise 2: als (log(errors) log(c)-qulog(a),start-list (c=1,q=1)) Assume S0 = 50, E- 47, T =0.5, D = 0.1, r=0.03,0 = 0.7. Determine experimentally the weak rate of convergence of the Euler's method for two options: (a) the regular European put option; (b) the option with the payoff 10, > 47 10,347 The exact price of this option at time t=0 is given by 10e - 75 In + (r-D-$T p(s) = $7). avf where is the cumulative distribution function of the standard normal distribution Use m = 2,4,8, 16 for determining the parameter . NB! The allowed error for the Monte-Carlo method has to be significantly smaller than the error that depends on m! Hint: Use the fact that weak convergence rate measures how different are the ex- pected values based on exact prices and approximate prices, generated using numer- ical method. For case (a) use Black-Scholes formulas to find the exact option price and compare it to the one from MC procedure and with stock prices generated using Euler's method. For case (b) formula for exact stock prices is given above, thus generate exact stock prices using the formula and approximate prices using Euler's method, apply MC procedure and compare estimated expected values. Convergence rate can be calculated applying the same command as in the exercise 2: als (log(errors) log(c)-qulog(a),start-list (c=1,q=1))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts