Question: R2 and negative beta (20 points) Suppose you develop a 2-factor model for expected stock returns of the following form: rarf=a+1(rmrf)+2(rzrf)+c You also calculate the

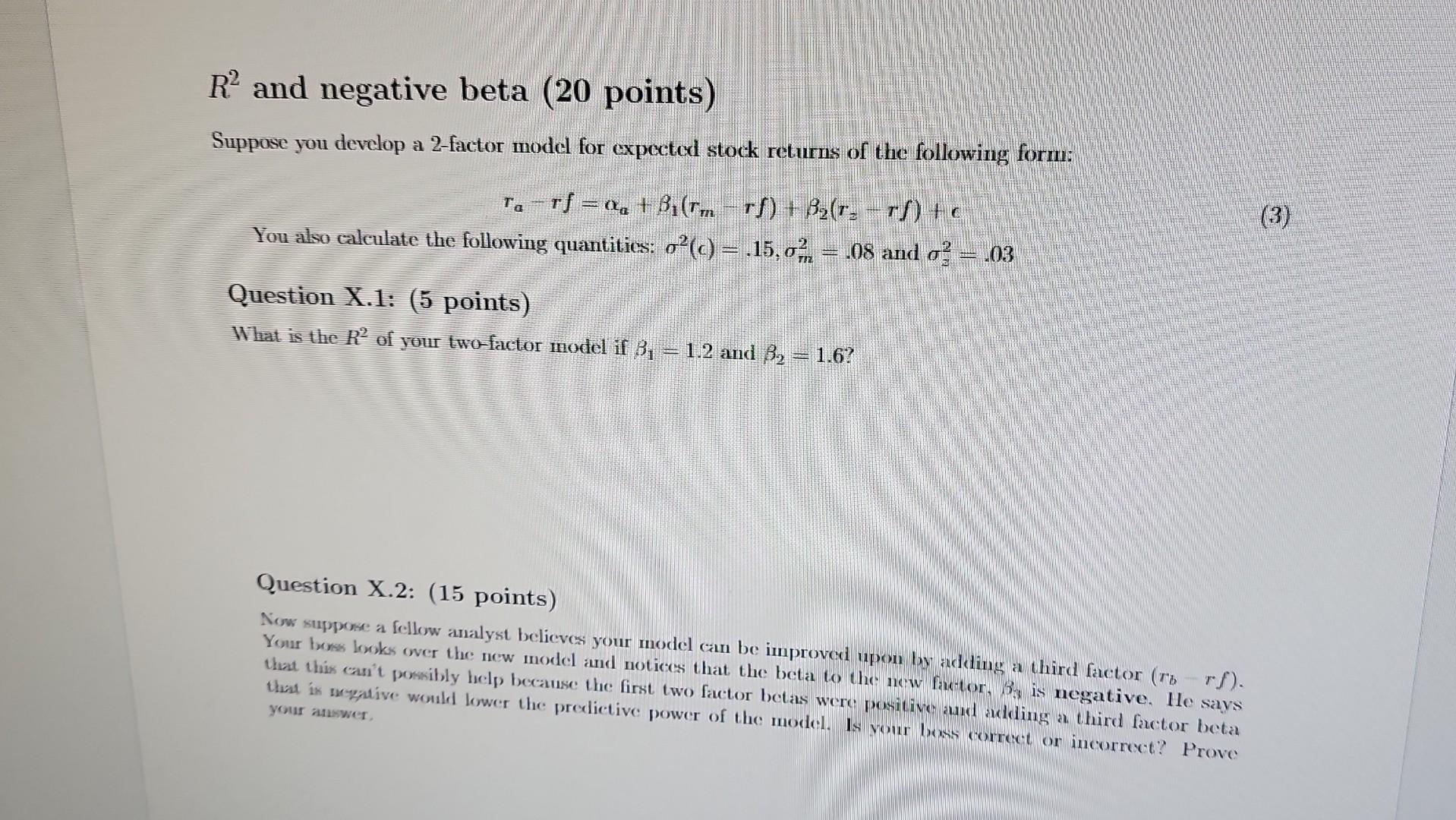

R2 and negative beta (20 points) Suppose you develop a 2-factor model for expected stock returns of the following form: rarf=a+1(rmrf)+2(rzrf)+c You also calculate the following quantities: 2(c)=.15,m2=.08 and z2=.03 Question X.1: (5 points) What is the R2 of your two-factor model if 1=1.2 and 2=1.6 ? Question X.2: (15 points) Now suppose a fellow analyst believes your model can be improved upon by adding a third factor (rbrf). Your bross books over the new model and notices that the beta to the new faktor, 3 is negative. He says that this can't powsibly help because the first two factor betas were positive and adding a third factor beta your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts