Question: R=5 Question 4 (a) An engineering company purchased a machine few years ago. The machine was purchased at a price of $(800,000 + R X5,000).

R=5

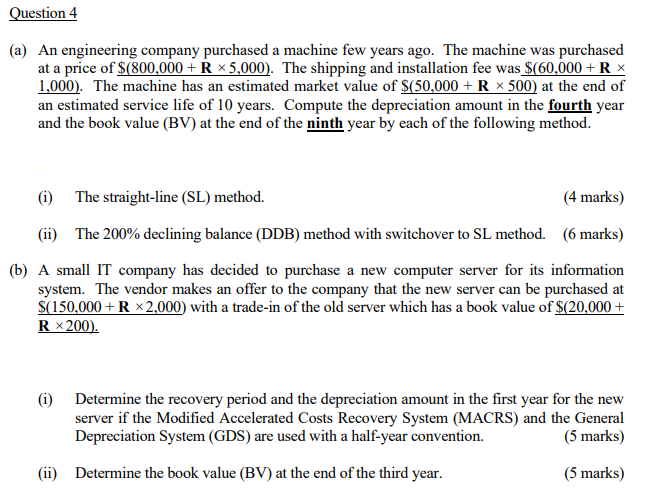

Question 4 (a) An engineering company purchased a machine few years ago. The machine was purchased at a price of $(800,000 + R X5,000). The shipping and installation fee was $(60,000+RX 1,000). The machine has an estimated market value of $(50,000 + R x 500) at the end of an estimated service life of 10 years. Compute the depreciation amount in the fourth year and the book value (BV) at the end of the ninth year by each of the following method. (1) The straight-line (SL) method. (4 marks) (ii) The 200% declining balance (DDB) method with switchover to SL method. (6 marks) (b) A small IT company has decided to purchase a new computer server for its information system. The vendor makes an offer to the company that the new server can be purchased at S(150,000+ R 2,000) with a trade-in of the old server which has a book value of $(20,000 + R 200). (1) Determine the recovery period and the depreciation amount in the first year for the new server if the Modified Accelerated Costs Recovery System (MACRS) and the General Depreciation System (GDS) are used with a half-year convention. (5 marks) (ii) Determine the book value (BV) at the end of the third year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts