Question: RAFAEL: During the 1 9 9 0 s , the consulting firm Stern, Stewart & Company developed the concept of Market Value Added, or MVA,

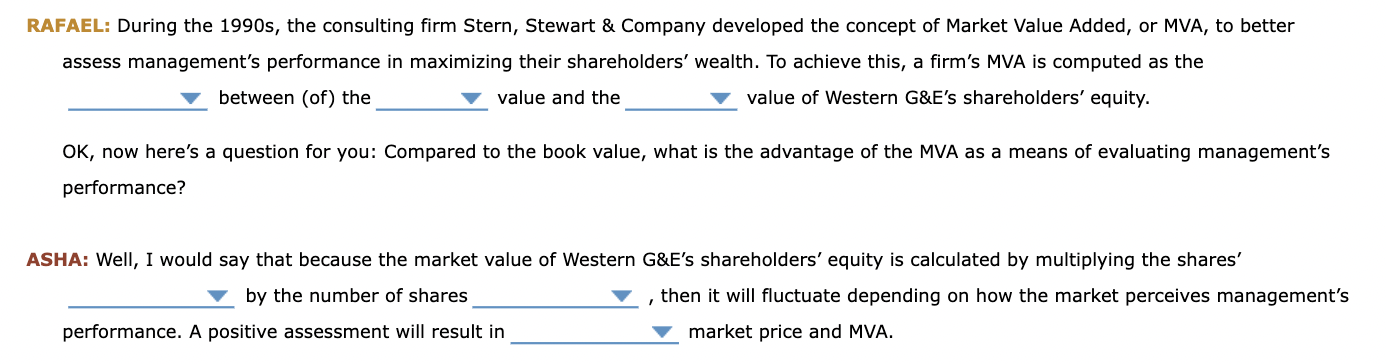

RAFAEL: During the s the consulting firm Stern, Stewart & Company developed the concept of Market Value Added, or MVA, to better

assess management's performance in maximizing their shareholders' wealth. To achieve this, a firm's MVA is computed as the

between of the

value and the

value of Western G&Es shareholders' equity.

OK now here's a question for you: Compared to the book value, what is the advantage of the MVA as a means of evaluating management's

performance?

ASHA: Well, I would say that because the market value of Western G&Es shareholders' equity is calculated by multiplying the shares'

by the number of shares

then it will fluctuate depending on how the market perceives management's

performance. A positive assessment will result in

I market price and MVA.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock