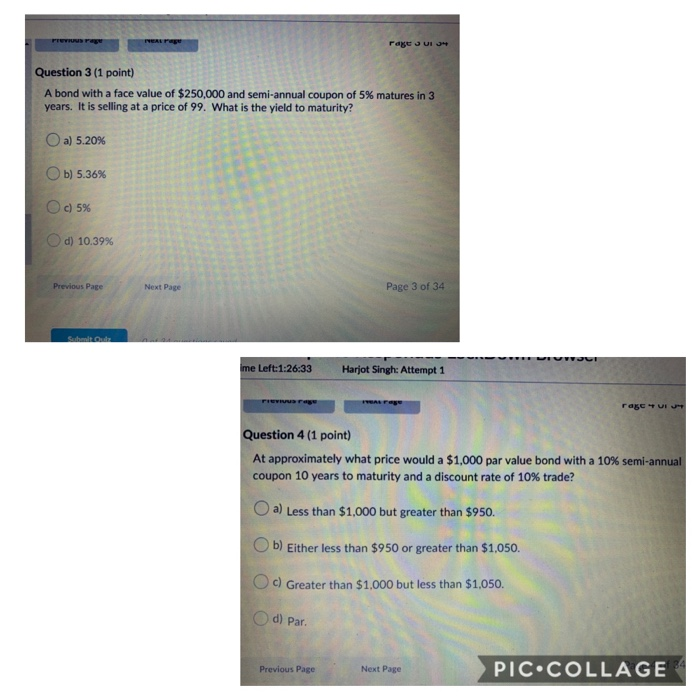

Question: rages UI 34 Question 3 (1 point) A bond with a face value of $250,000 and semi-annual coupon of 5% matures in 3 years. It

rages UI 34 Question 3 (1 point) A bond with a face value of $250,000 and semi-annual coupon of 5% matures in 3 years. It is selling at a price of 99. What is the yield to maturity? a) 5.20% Ob) 5.36% c) 5% d) 10.39% Previous Page Next Page Page 3 of 34 Ime Left:1:26:33 Harjot Singh: Attempt 1 rase "VIJ? Question 4 (1 point) At approximately what price would a $1,000 par value bond with a 10% semi-annual coupon 10 years to maturity and a discount rate of 10% trade? a) Less than $1,000 but greater than $950. b) Either less than $950 or greater than $1,050. Oc) Greater than $1,000 but less than $1,050. d) Par Previous Page Next Page PIC.COLLAGE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts