Question: Rahul and Ruby are married taxpayers. They are both under age 65 and in good health. For 2022, they have a total of $89,000 in

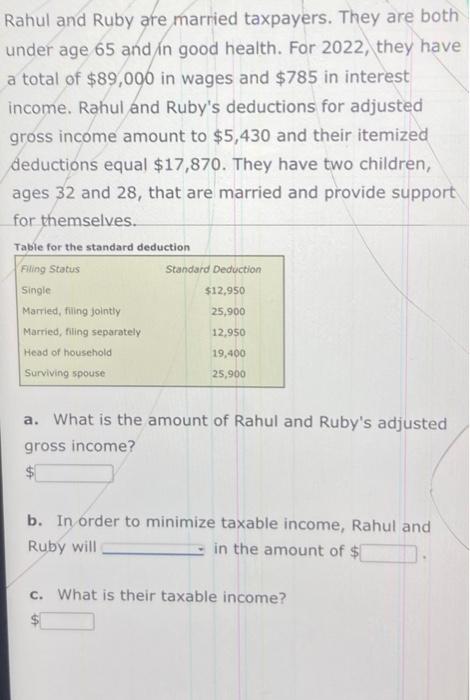

Rahul and Ruby are married taxpayers. They are both under age 65 and in good health. For 2022, they have a total of $89,000 in wages and $785 in interest income. Rahul and Ruby's deductions for adjusted gross income amount to $5,430 and their itemized deductions equal $17,870. They have two children, ages 32 and 28 , that are married and provide support for themselves. Table for the standard deduction a. What is the amount of Rahul and Ruby's adjusted gross income? b. In order to minimize taxable income, Rahul and Ruby will in the amount of \$ c. What is their taxable income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock