Question: Raider Manufacturing (RM) capital structure is all equity. It has 200,000 shares of $2 par value common stock outstanding. When its founder, who was also

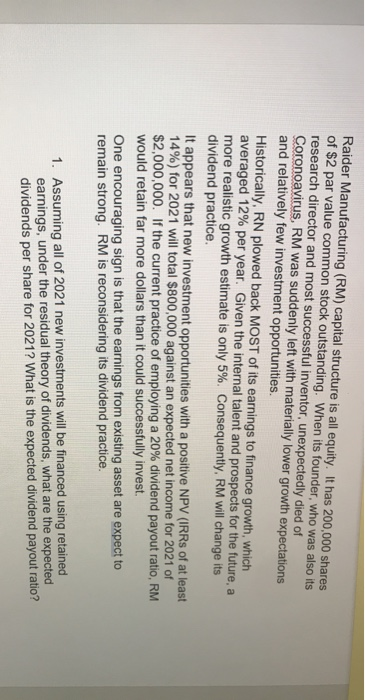

Raider Manufacturing (RM) capital structure is all equity. It has 200,000 shares of $2 par value common stock outstanding. When its founder, who was also its research director and most successful inventor, unexpectedly died of Coronoavirus, RM was suddenly left with materially lower growth expectations and relatively few investment opportunities. Historically, RN plowed back MOST of its earnings to finance growth, which averaged 12% per year. Given the internal talent and prospects for the future, a more realistic growth estimate is only 5%. Consequently, RM will change its dividend practice. It appears that new investment opportunities with a positive NPV (IRRs of at least 14%) for 2021 will total $800,000 against an expected net income for 2021 of $2,000,000. If the current practice of employing a 20% dividend payout ratio, RM would retain far more dollars than it could successfully invest. One encouraging sign is that the earnings from existing asset are expect to remain strong. RM is reconsidering its dividend practice. 1. Assuming all of 2021 new investments will be financed using retained earnings, under the residual theory of dividends, what are the expected dividends per share for 2021? What is the expected dividend payout ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts