Question: Rainbow INC Allowance Method? Please show all work QUESTION 1- Part 1 Rainbow Inc uses the allowance method when accounting for bad debt and employs

Rainbow INC Allowance Method? Please show all work

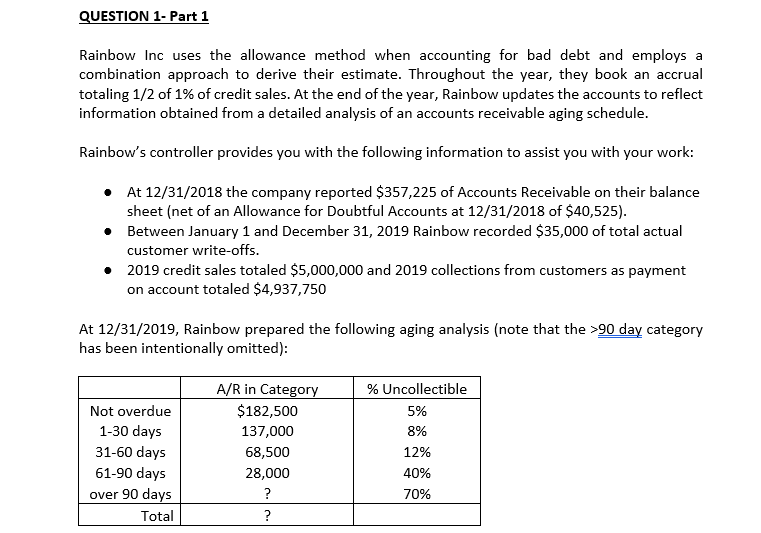

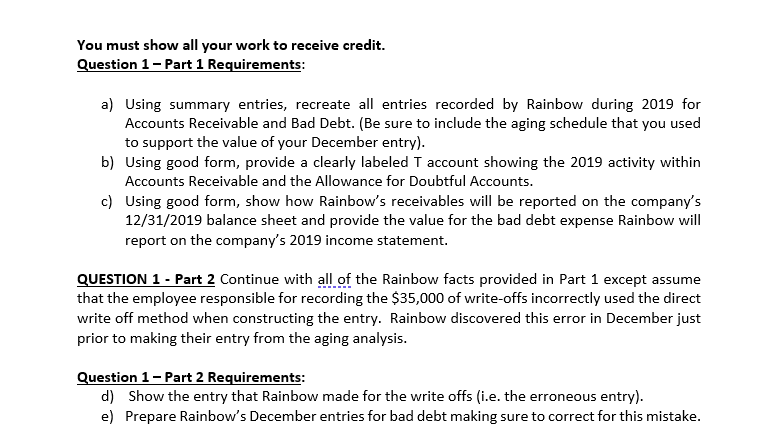

QUESTION 1- Part 1 Rainbow Inc uses the allowance method when accounting for bad debt and employs a combination approach to derive their estimate. Throughout the year, they book an accrual totaling 1/2 of 1% of credit sales. At the end of the year, Rainbow updates the accounts to reflect information obtained from a detailed analysis of an accounts receivable aging schedule. Rainbow's controller provides you with the following information to assist you with your work: At 12/31/2018 the company reported $357,225 of Accounts Receivable on their balance sheet (net of an Allowance for Doubtful Accounts at 12/31/2018 of $40,525). Between January 1 and December 31, 2019 Rainbow recorded $35,000 of total actual customer write-offs. 2019 credit sales totaled $5,000,000 and 2019 collections from customers as payment on account totaled $4,937,750 At 12/31/2019, Rainbow prepared the following aging analysis (note that the >90 day category has been intentionally omitted): % Uncollectible Not overdue 1-30 days 31-60 days 61-90 days over 90 days Total A/R in Category $182,500 137,000 68,500 28,000 8% 12% 40% 70% You must show all your work to receive credit. Question 1 - Part 1 Requirements: a) Using summary entries, recreate all entries recorded by Rainbow during 2019 for Accounts Receivable and Bad Debt. (Be sure to include the aging schedule that you used to support the value of your December entry). b) Using good form, provide a clearly labeled T account showing the 2019 activity within Accounts Receivable and the Allowance for Doubtful Accounts. c) Using good form, show how Rainbow's receivables will be reported on the company's 12/31/2019 balance sheet and provide the value for the bad debt expense Rainbow will report on the company's 2019 income statement. QUESTION 1 - Part 2 Continue with all of the Rainbow facts provided in Part 1 except assume that the employee responsible for recording the $35,000 of write-offs incorrectly used the direct write off method when constructing the entry. Rainbow discovered this error in December just prior to making their entry from the aging analysis. Question 1 - Part 2 Requirements: d) Show the entry that Rainbow made for the write offs (i.e. the erroneous entry). e) Prepare Rainbow's December entries for bad debt making sure to correct for this mistake

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts