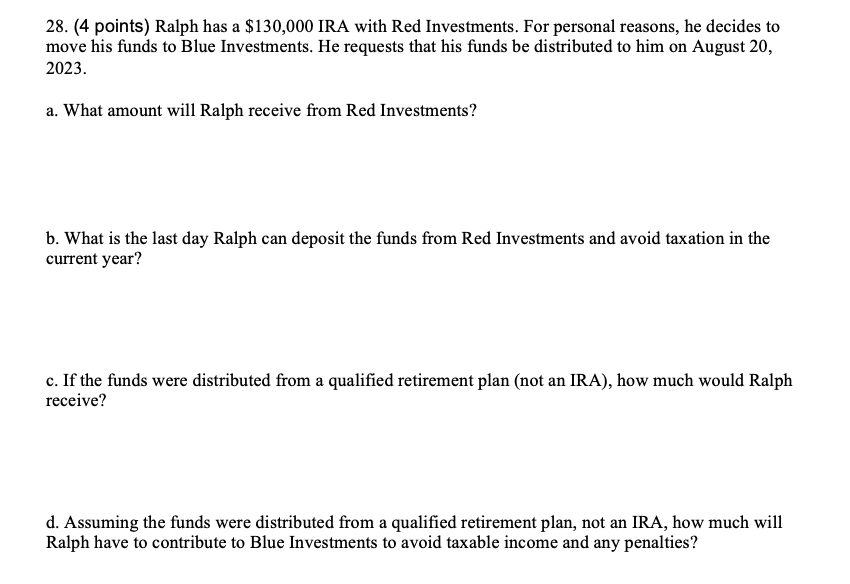

Question: Ralph has a $ 1 3 0 , 0 0 0 IRA with Red Investments. For personal reasons, he decides to move his funds to

Ralph has a $ IRA with Red Investments. For personal reasons, he decides to

move his funds to Blue Investments. He requests that his funds be distributed to him on August

a What amount will Ralph receive from Red Investments?

b What is the last day Ralph can deposit the funds from Red Investments and avoid taxation in the

current year?

c If the funds were distributed from a qualified retirement plan not an IRA how much would Ralph

receive?

d Assuming the funds were distributed from a qualified retirement plan, not an IRA, how much will

Ralph have to contribute to Blue Investments to avoid taxable income and any penalties?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock