Question: Randy Marsh Incorporated uses an activity-based costing system with three activity cost pools: Growing, Packaging, and other. Randy Marsh allocates overhead costs in the two

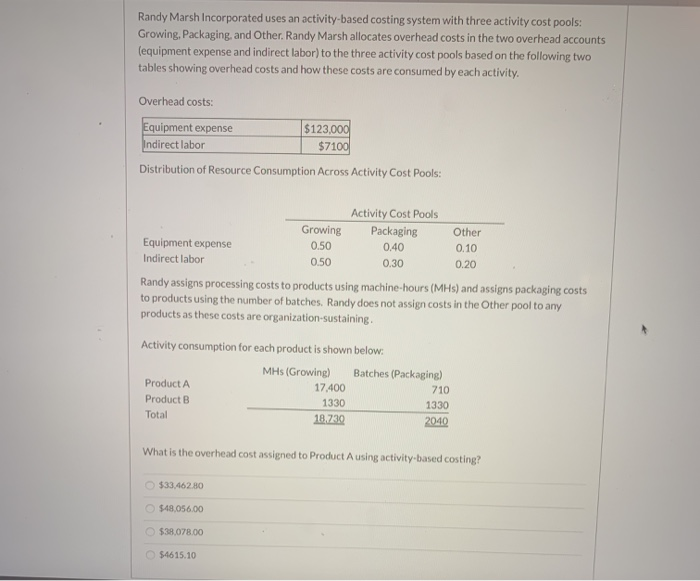

Randy Marsh Incorporated uses an activity-based costing system with three activity cost pools: Growing, Packaging, and other. Randy Marsh allocates overhead costs in the two overhead accounts (equipment expense and indirect labor) to the three activity cost pools based on the following two tables showing overhead costs and how these costs are consumed by each activity. Overhead costs: Equipment expense Indirect labor $123,000 $7100 Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools Packaging 0.40 0.30 Growing 0.50 0.50 Equipment expense Indirect labor Other 0.10 0.20 Randy assigns processing costs to products using machine hours (MHS) and assigns packaging costs to products using the number of batches. Randy does not assign costs in the other pool to any products as these costs are organization-sustaining Activity consumption for each product is shown below: MHS (Growing) Batches (Packaging) Product A 17.400 710 Product B 1330 1330 Total 18.730 2040 What is the overhead cost assigned to Product A using activity-based costing? $33,46280 $48,056.00 $38.078.00 $4615.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts