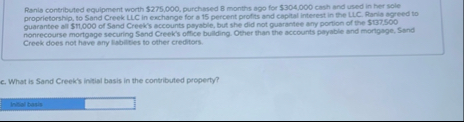

Question: Ranis contributed equipment worth $ 2 7 5 , 0 0 0 , purchased 8 months ago for $ 3 0 4 , 0 0

Ranis contributed equipment worth $ purchased months ago for $ cash and used in her sole proprietornhl, o and Creet C in earhange for percent orofits and capital interest in the LLC Ranis agreed to nonrecourse mortgage securing Sand Creek's office bullding. Other than the accounts payable and montgage, Sand Creek does not have any liabilities to other creditors.

c What is Sand Creek's initial basis in the contributed property?

Inital basis

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock