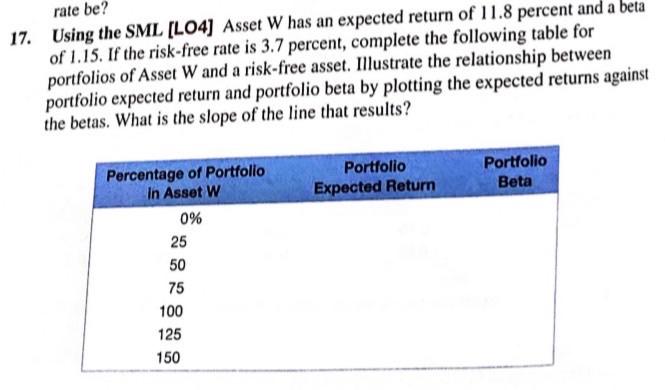

Question: rate be? 17. Using the SML (LO4) Asset W has an expected return of 11.8 percent and a beta of 1.15. If the risk-free rate

rate be? 17. Using the SML (LO4) Asset W has an expected return of 11.8 percent and a beta of 1.15. If the risk-free rate is 3.7 percent, complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the relationship between portfolio expected return and portfolio beta by plotting the expected returns against the betas. What is the slope of the line that results? Portfolio Expected Return Portfolio Beta Percentage of Portfolio In Asset W 0% 25 50 75 100 125 150

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts