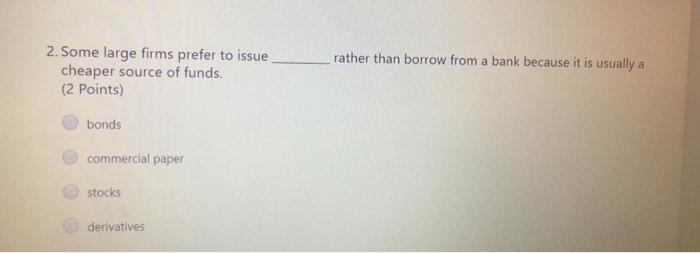

Question: rather than borrow from a bank because it is usually a 2. Some large firms prefer to issue cheaper source of funds. (2 points) bonds

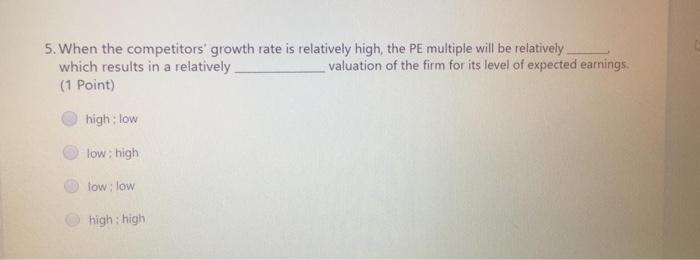

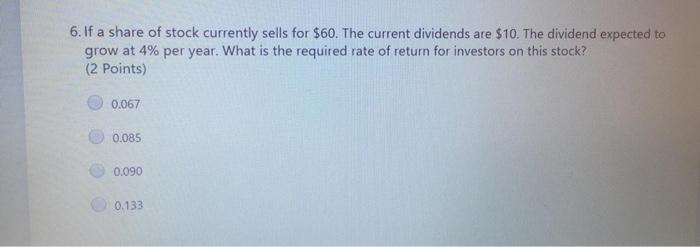

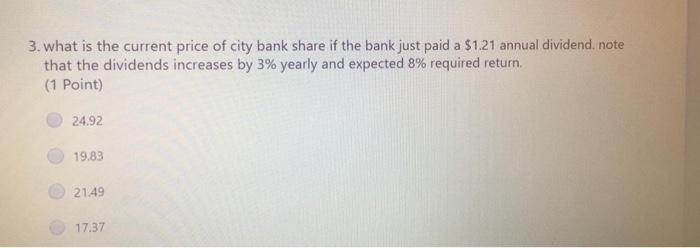

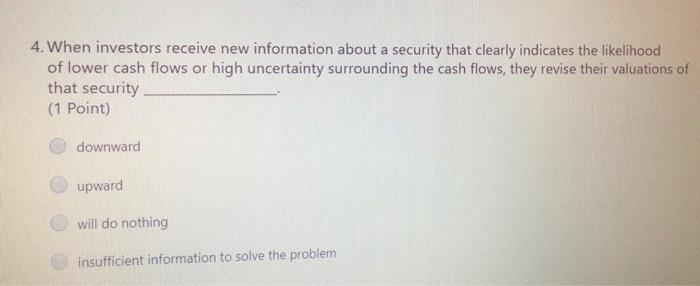

rather than borrow from a bank because it is usually a 2. Some large firms prefer to issue cheaper source of funds. (2 points) bonds commercial paper stocks derivatives 5. When the competitors' growth rate is relatively high, the PE multiple will be relatively which results in a relatively valuation of the firm for its level of expected earnings (1 Point) high: low low: high Tow: low high : high 6. If a share of stock currently sells for $60. The current dividends are $10. The dividend expected to grow at 4% per year. What is the required rate of return for investors on this stock? (2 points) 0.067 0.085 0.090 0.133 3. what is the current price of city bank share if the bank just paid a $1.21 annual dividend. note that the dividends increases by 3% yearly and expected 8% required return. (1 Point) 24.92 19.89 21.49 17.37 4. When investors receive new information about a security that clearly indicates the likelihood of lower cash flows or high uncertainty surrounding the cash flows, they revise their valuations of that security (1 Point) downward upward will do nothing insufficient information to solve the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts