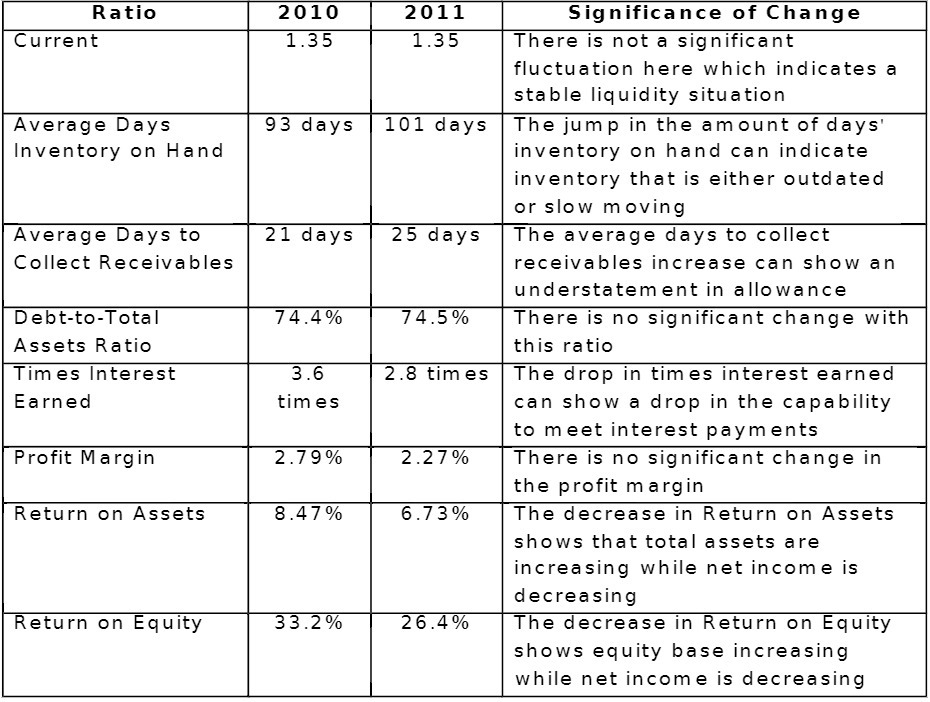

Question: Ratio 2010 Average Days Inventory on Hand Average Days to Collect Receivables 74.4% Debt-to-Total Times Interest 3.6 Earned times 2.79% Profit Margin Return on Assets

Ratio 2010 Average Days Inventory on Hand Average Days to Collect Receivables 74.4% Debt-to-Total Times Interest 3.6 Earned times 2.79% Profit Margin Return on Assets 8.47% Return on Equity 33.2% 21 days 2011 101 days 26.4% Significance of Change There is not a significant fluctuation here which indicates a stable liquidity situation The jum p in the amount of days' inventory on hand can indicate inventory that is either outdated or slow moving The average days to collect receivables increase can show an understatement in allowance There is no significant change with this ratio The drop in times interest earned can show a drop in the capability to meet interest payments There is no significant change in the profit margin The decrease in Return on Assets shows that total assets are increasing while net income is decreasing The decrease in Return on Equity shows equity base increasing while net income is decreasing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts