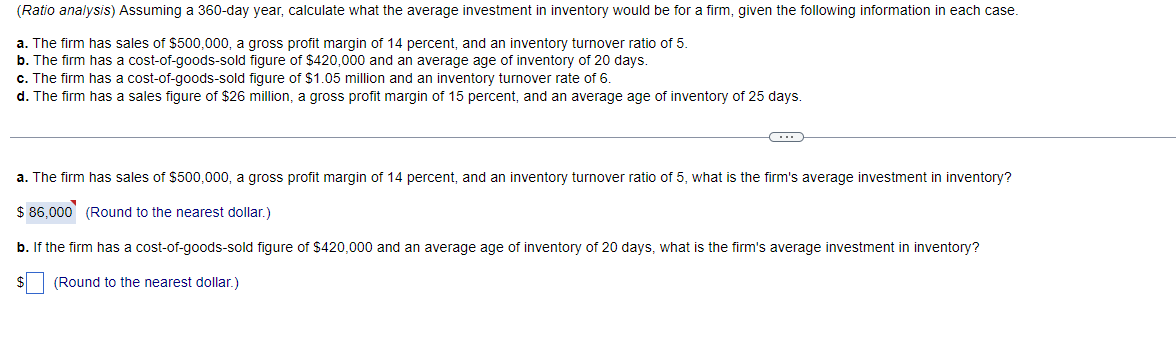

Question: (Ratio analysis) Assuming a 360-day year, calculate what the average investment in inventory would be for a firm, given the following information in each case.

(Ratio analysis) Assuming a 360-day year, calculate what the average investment in inventory would be for a firm, given the following information in each case. a. The firm has sales of $500,000, a gross profit margin of 14 percent, and an inventory turnover ratio of 5 . b. The firm has a cost-of-goods-sold figure of $420,000 and an average age of inventory of 20 days. c. The firm has a cost-of-goods-sold figure of $1.05 million and an inventory turnover rate of 6 . d. The firm has a sales figure of $26 million, a gross profit margin of 15 percent, and an average age of inventory of 25 days. a. The firm has sales of $500,000, a gross profit margin of 14 percent, and an inventory turnover ratio of 5 , what is the firm's average investment in inventory? (Round to the nearest dollar.) b. If the firm has a cost-of-goods-sold figure of $420,000 and an average age of inventory of 20 days, what is the firm's average investment in inventory? $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts