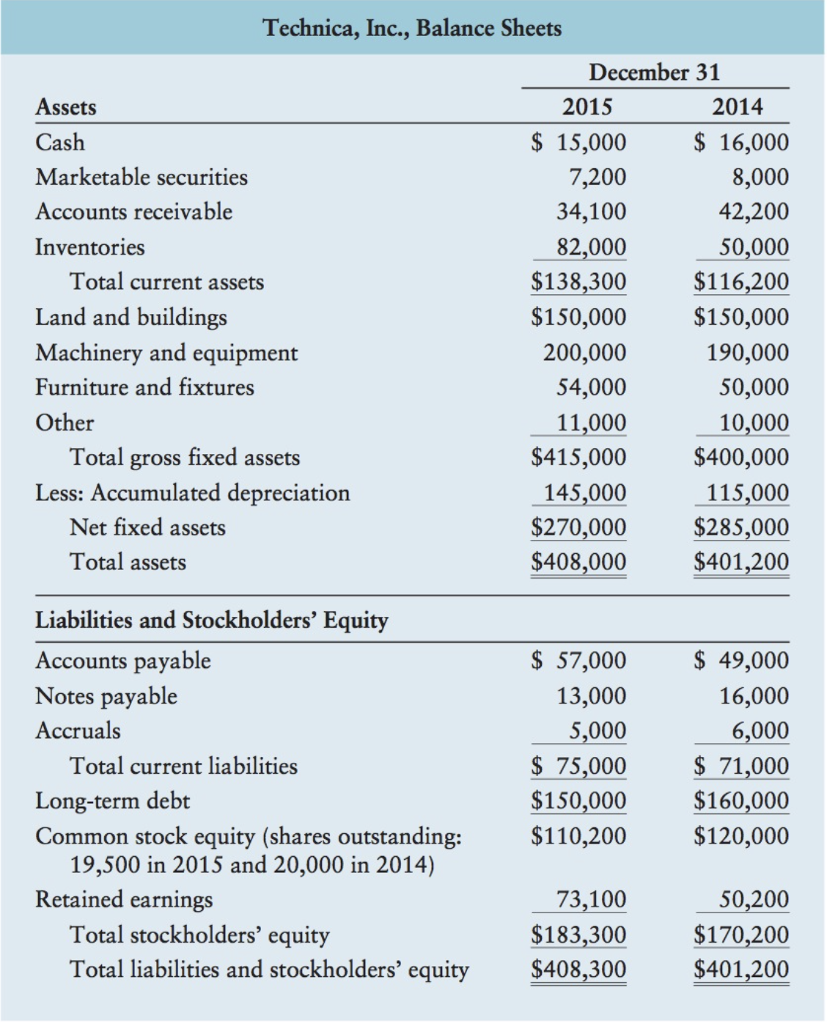

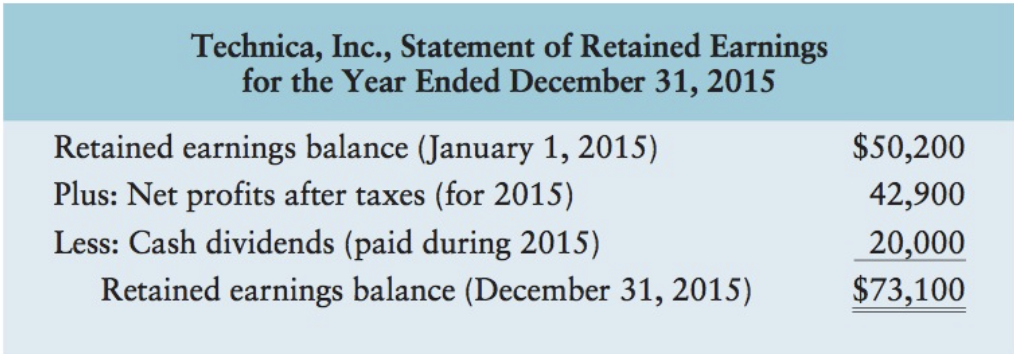

Question: ratio analysis for both 2014 and 2015 (current ratio, quick ratio, inventory turnover, total asset turnover, debt ratio, net profit margin) and DuPont Analysis for

ratio analysis for both 2014 and 2015 (current ratio, quick ratio, inventory turnover, total asset turnover, debt ratio, net profit margin) and DuPont Analysis for both 2014 and 2015 (ROA showing both parts of the analysis AND ROE showing all three parts of the analysis);

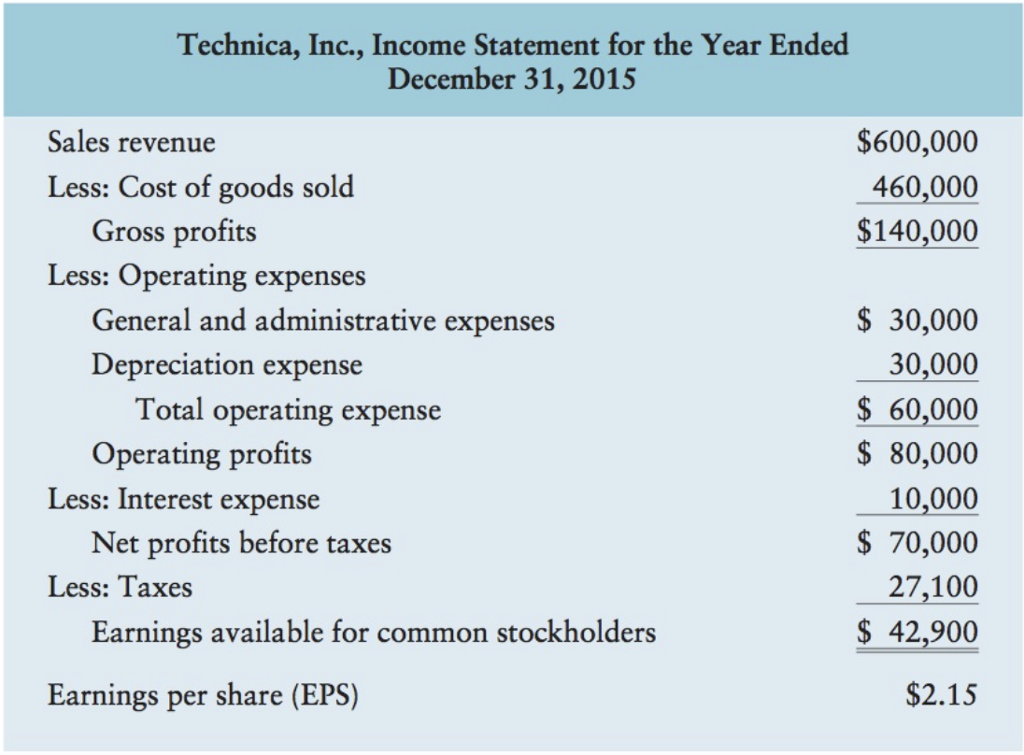

Technica, Inc., Income Statement for the Year Ended December 31, 2015 $600,000 460,000 $140,000 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses $30,000 30,000 60,000 $ 80,000 10,000 $ 70,000 27,100 $ 42,900 $2.15 General and administrative expenses Depreciation expense Operating profits Net profits before taxes Total operating expense Less: Interest expense Less: Taxes Earnings available for common stockholders Earnings per share (EPS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts