Question: RATIO ASSIGNMENT 2 Du Pont Equation 1. ROE-( 2. ROA ( 3. ROE-( 4. EM-+ 5. Other things are constant. If a firm increases NPM,

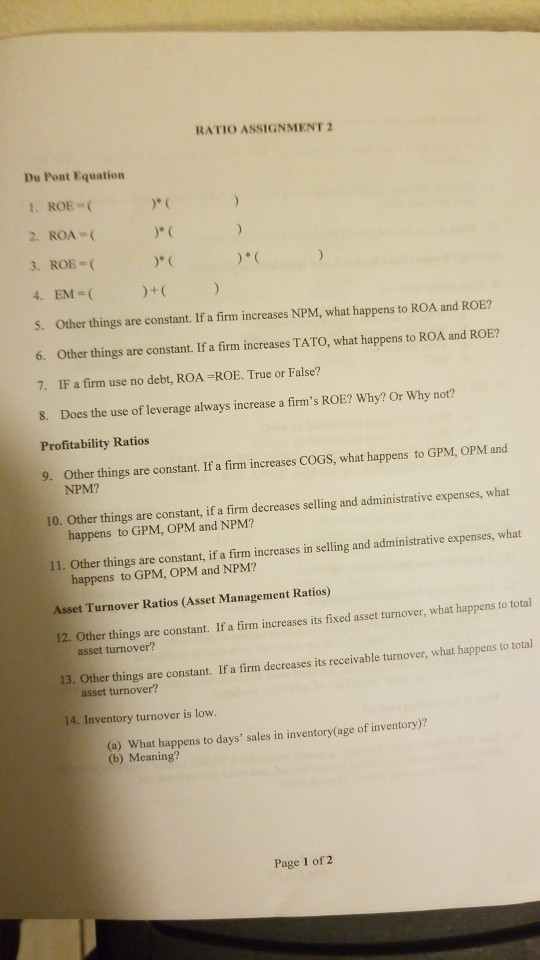

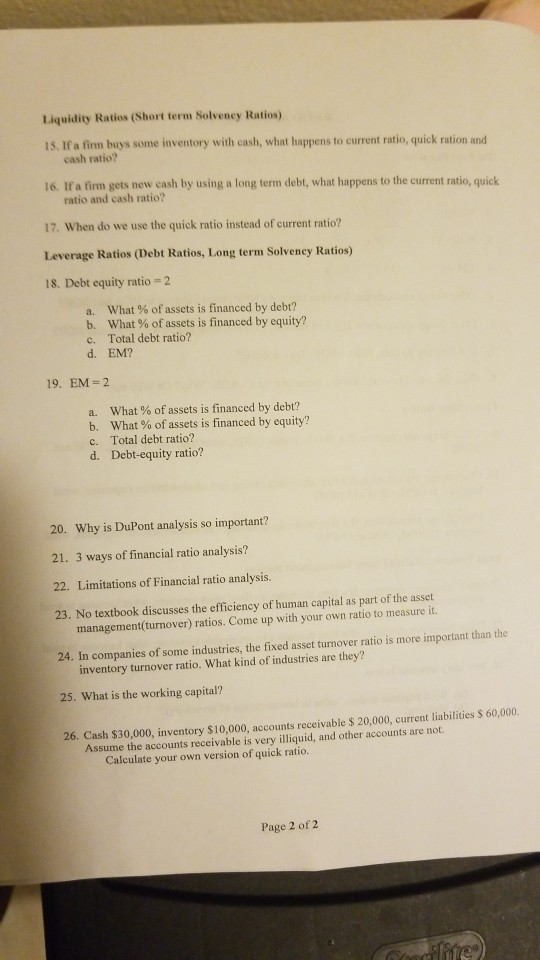

RATIO ASSIGNMENT 2 Du Pont Equation 1. ROE-( 2. ROA ( 3. ROE-( 4. EM-+ 5. Other things are constant. If a firm increases NPM, what happens to ROA and ROE? 6. Other things are constant. If a firm increases TATO, what happens to ROA and ROE? 7. IF a firm use no debt, ROA-ROE. True or False? 8. Does the use of leverage always increase a firm's ROE? Why? Or Why not? Profitability Ratios 9. Other things are constant. If a firm increases CoGS, what happens to GPM, OPM and NPM? 10. Other things are constant, if a firm decreases selling and administrative expenses, what happens to GPM, OPM and NPM? 11. Other things are constant, if a firm increases in selling and administrative expenses, what happens to GPM, OPM and NPM? Asset Turnover Ratios (Asset Management Ratios) 12. Other things are constant. If a firm increases its fixed asset turnover, what happens to total asset turnover? 13. Other things are constant. If a firm decreases its receivable turnover, what happens to total asset turnover? 14. Inventory turnover is low (a) What happens to days' sales in inventory(age of inventory)? (b) Meaning? Page 1 of 2 Liquidity Ratios (Short term Solvency Ratios 1S. If a firm buys some inventory with cash, what happens to current ratio, quick ration and cash ratio? 16. If a firm gets new cash by using a long term debt, what happens to the current ratio, quick ratio and cash ratio? 17. When do we use the quick ratio instead of current ratio? Leverage Ratios (Debt Ratios, Long term Solvency Ratios) 18. Debt equity ratio 2 a. b, c. d. what % of assets is financed by debt? what % of assets is financed by equity? Total debt ratio? EM? 19. EM 2 a. b. c. d. What % of assets is financed by debt? What %ofassets is financed by equity? Total debt ratio? Debt-equity ratio? 20. Why is DuPont analysis so important? 21. 3 ways of financial ratio analysis? 22. Limitations of Financial ratio analysis. 23. No textbook discusses the efficiency of human capital as part of the asset management(turnover) ratios. Come up with your own ratio to measure it. 24. In companies of some industries, the fixed asset turnover ratio is more important than the inventory turnover ratio. What kind of industries are they? 25. What is the working capital? 26. Cash $30,000, inventory $10,000, accounts receivable s 20,000, current liabilities S 60,000. Assume the accounts receivable is very illiquid, and other accounts are not Calculate your own version of quick ratio. Page 2 of 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts