Question: Ratio Assignment. Thank you very much!!! RATIO PROBLEM - DUE DECEMBER 9IH (23 POINTS) ACCTG 231 ends the semester with a step back into working

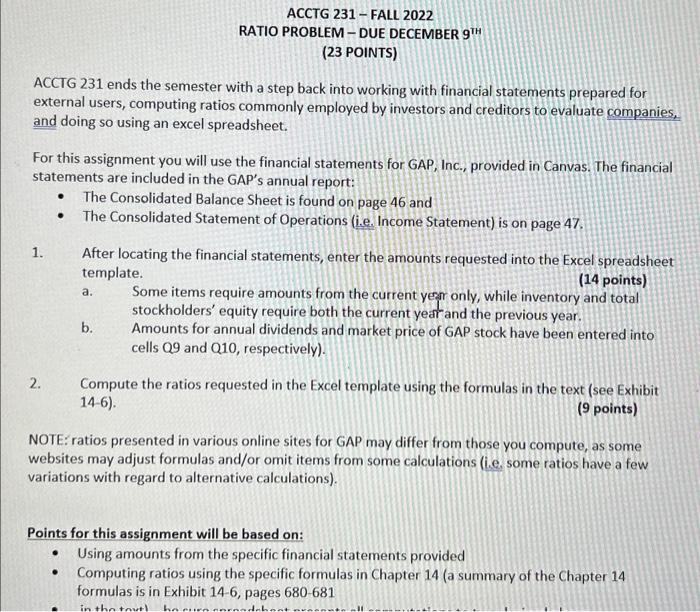

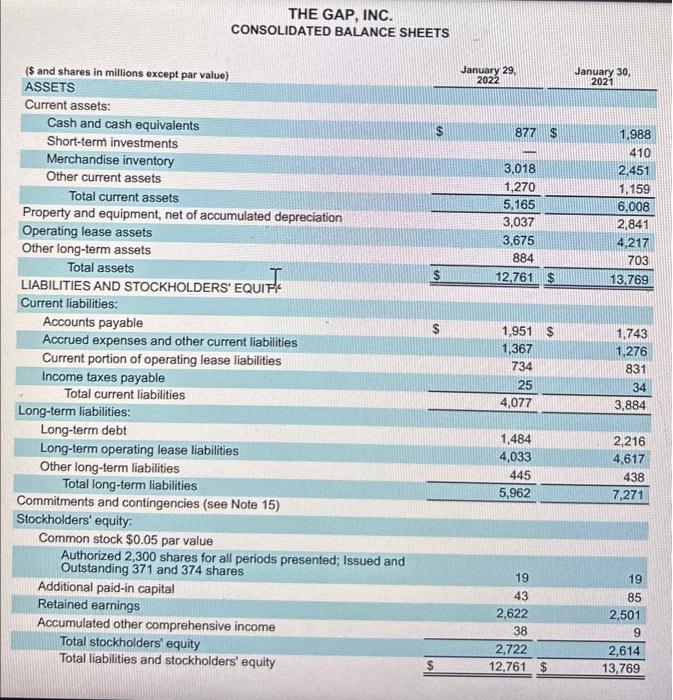

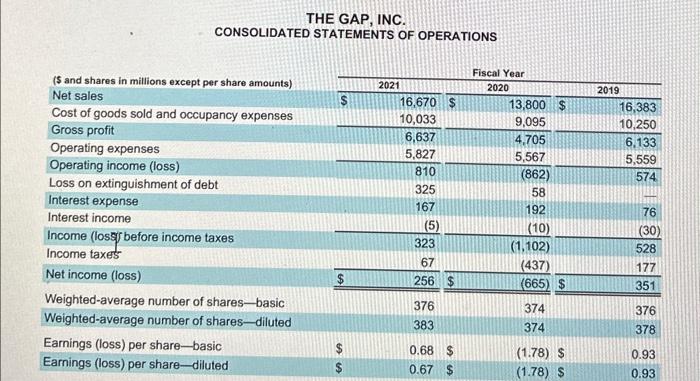

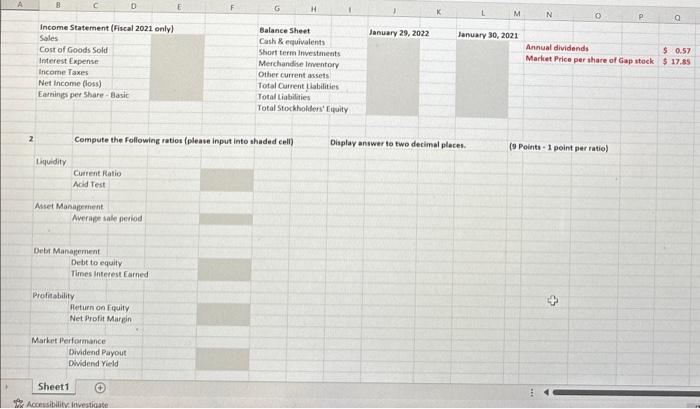

RATIO PROBLEM - DUE DECEMBER 9IH (23 POINTS) ACCTG 231 ends the semester with a step back into working with financial statements prepared for external users, computing ratios commonly employed by investors and creditors to evaluate companies, and doing so using an excel spreadsheet. For this assignment you will use the financial statements for GAP, Inc., provided in Canvas. The financial statements are included in the GAP's annual report: - The Consolidated Balance Sheet is found on page 46 and - The Consolidated Statement of Operations (i.e. Income Statement) is on page 47. 1. After locating the financial statements, enter the amounts requested into the Excel spreadsheet template. (14 points) a. Some items require amounts from the current yegr only, while inventory and total stockholders' equity require both the current yearand the previous year. b. Amounts for annual dividends and market price of GAP stock have been entered into cells Q9 and Q10, respectively). 2. Compute the ratios requested in the Excel template using the formulas in the text (see Exhibit 14-6). ( 9 points) NOTE: ratios presented in various online sites for GAP may differ from those you compute, as some websites may adjust formulas and/or omit items from some calculations (i.e. some ratios have a few variations with regard to alternative calculations). Points for this assignment will be based on: - Using amounts from the specific financial statements provided - Computing ratios using the specific formulas in Chapter 14 (a summary of the Chapter 14 formulas is in Exhibit 14-6, pages 680-681 THE GAP, INC. CONSOLIDATED BALANCE SHEETS THE GAP, INC. CONSOLIDATED STATEMENTS OF OPERATIONS 2 Compute the following ration (please input into shaded cell) Display answer to two decimal ploces. (9 Points - 1 point per ratio) Liguidity. Cutrent Ratio Acid Test Asset Masapernent Averape sale period Debr Managernent Debt to equity Times interest Earned Profitabilify Aleturn on Fipuity Net Profit Margin Market Performance Dividend Payout Dividend yield Sheet1 RATIO PROBLEM - DUE DECEMBER 9IH (23 POINTS) ACCTG 231 ends the semester with a step back into working with financial statements prepared for external users, computing ratios commonly employed by investors and creditors to evaluate companies, and doing so using an excel spreadsheet. For this assignment you will use the financial statements for GAP, Inc., provided in Canvas. The financial statements are included in the GAP's annual report: - The Consolidated Balance Sheet is found on page 46 and - The Consolidated Statement of Operations (i.e. Income Statement) is on page 47. 1. After locating the financial statements, enter the amounts requested into the Excel spreadsheet template. (14 points) a. Some items require amounts from the current yegr only, while inventory and total stockholders' equity require both the current yearand the previous year. b. Amounts for annual dividends and market price of GAP stock have been entered into cells Q9 and Q10, respectively). 2. Compute the ratios requested in the Excel template using the formulas in the text (see Exhibit 14-6). ( 9 points) NOTE: ratios presented in various online sites for GAP may differ from those you compute, as some websites may adjust formulas and/or omit items from some calculations (i.e. some ratios have a few variations with regard to alternative calculations). Points for this assignment will be based on: - Using amounts from the specific financial statements provided - Computing ratios using the specific formulas in Chapter 14 (a summary of the Chapter 14 formulas is in Exhibit 14-6, pages 680-681 THE GAP, INC. CONSOLIDATED BALANCE SHEETS THE GAP, INC. CONSOLIDATED STATEMENTS OF OPERATIONS 2 Compute the following ration (please input into shaded cell) Display answer to two decimal ploces. (9 Points - 1 point per ratio) Liguidity. Cutrent Ratio Acid Test Asset Masapernent Averape sale period Debr Managernent Debt to equity Times interest Earned Profitabilify Aleturn on Fipuity Net Profit Margin Market Performance Dividend Payout Dividend yield Sheet1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts