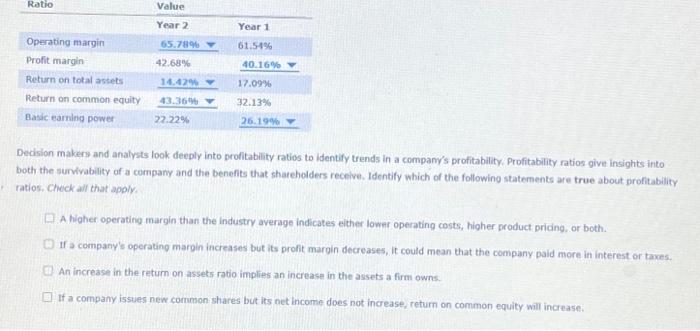

Question: Ratio Operating margin Profit margin Return on total assets Return on common equity Basic earning power Value Year 2 65.78% V 42.68% 14.42% 43.36% 22.22%

Decision makers and analysts look deeply into profitability ratios to identify trends in a company's profitability. Profitability ratios give insights into both the survivability of a company and the benefits that shareholders recelve. Identify which of the following statements are true about profitability ratios, check all that apply. A higher operating margin than the industry average indicates either lower operating costs, higher product pricing, or both. If a company's operating maroin increases but its profit maroin decreases, it could mean that the company paid more in interest or taxes. An increase in the return on assets ratio implies an increase in the assets a firm owns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts