Question: - Ratios that help determine whether a company can access its cash and pay its short-term obligations are called ratios. - Ratios that help determine

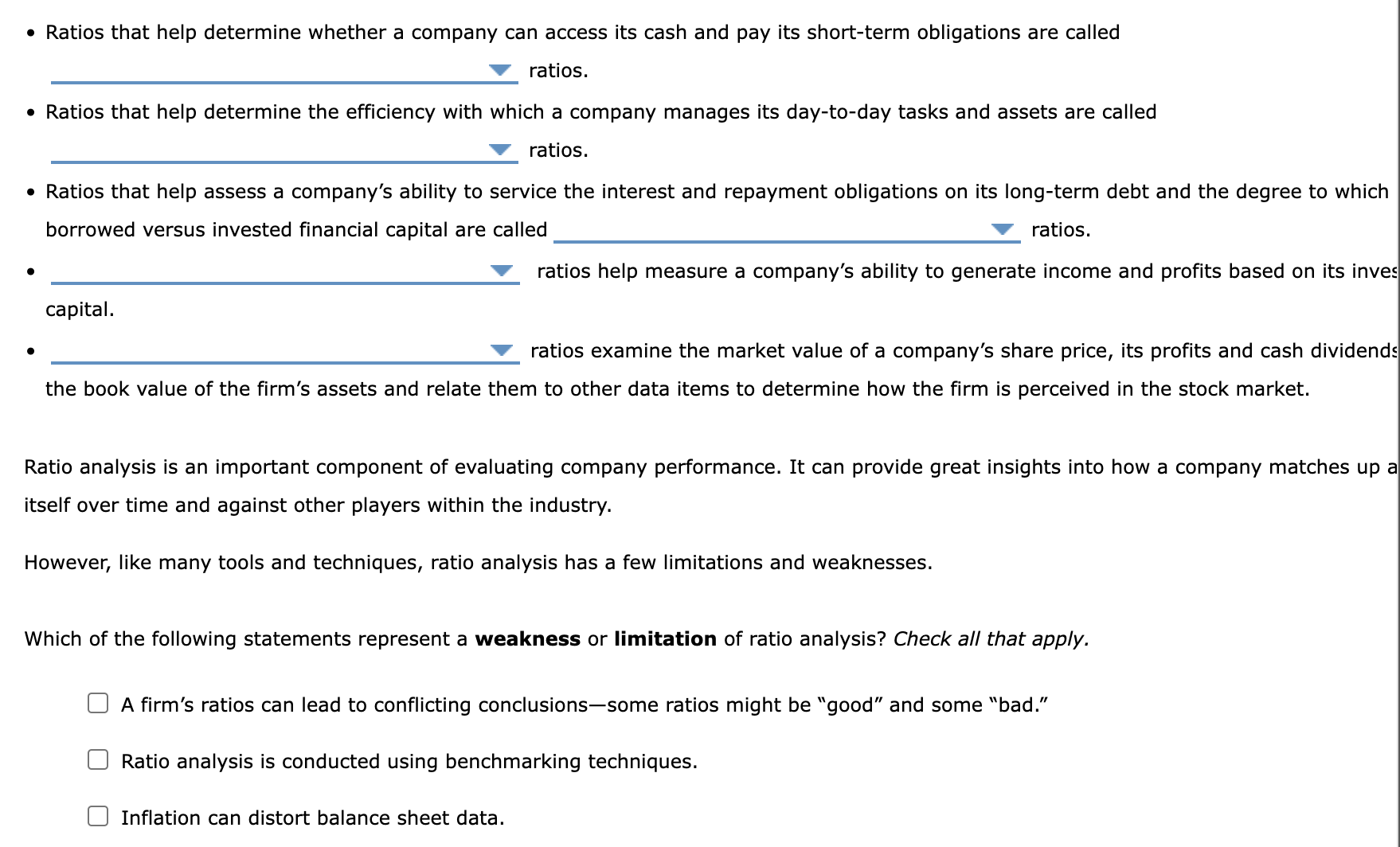

- Ratios that help determine whether a company can access its cash and pay its short-term obligations are called ratios. - Ratios that help determine the efficiency with which a company manages its day-to-day tasks and assets are called ratios. - Ratios that help assess a company's ability to service the interest and repayment obligations on its long-term debt and the degree to which borrowed versus invested financial capital are called ratios. ratios help measure a company's ability to generate income and profits based on its inve capital. - _ _ ratios examine the market value of a company's share price, its profits and cash dividend the book value of the firm's assets and relate them to other data items to determine how the firm is perceived in the stock market. Ratio analysis is an important component of evaluating company performance. It can provide great insights into how a company matches up itself over time and against other players within the industry. However, like many tools and techniques, ratio analysis has a few limitations and weaknesses. Which of the following statements represent a weakness or limitation of ratio analysis? Check all that apply. A firm's ratios can lead to conflicting conclusions-some ratios might be "good" and some "bad." Ratio analysis is conducted using benchmarking techniques. Inflation can distort balance sheet data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts