Question: Ratios that help determine whether a compuny can access its cash and pay its short - term obligations are called ratios. Ratios that help determine

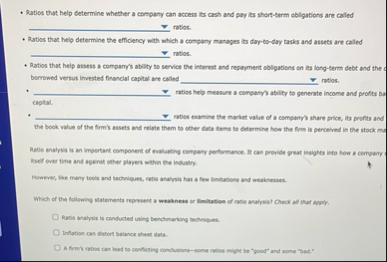

Ratios that help determine whether a compuny can access its cash and pay its shortterm obligations are called

ratios.

Ratios that help determine the efficiency with which a company manages its daytoday tasks and assets are called

ratios.

Ratios that help assess a company's ability to service the trevert and regayment obligablons on ils longterm debt and the borrowed versus invested financial capital are called. ratios.

; ratios halp massure a company's ability to generate income and profics ba capital.

E ratios examine the merhet walue of a company's share price, its profits and The book value of the frms assets and relate them to other data kerses to determine how the from is perceived in the stock me

Ratio analysis is an important component of evaluating company performance. It can provide preat insighes into fow a company Rueif over time and apainst other players within the induster.

However, the many toots and Bechnioues, ratio analysis has a frow limitations and weakenses.

Which of the following statements represent a weakness or Ilmittatiene of ratio analysis? Check all that apply.

fortio arahylis is conducted using benchmariang peomepues.

Inflation ress elsore balancer shout cars.

A firm't rutios can linad to conflicting conclusionssome ratiss miget be "pood" and some "pad."

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock