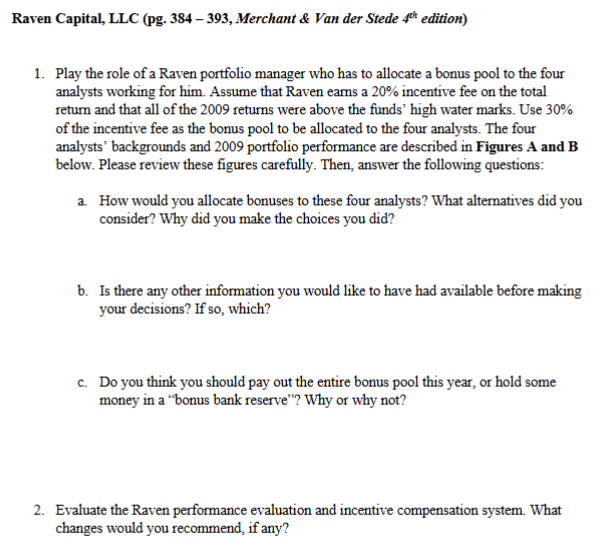

Question: Raven Capital, LLC ( pg . 3 8 4 3 9 3 , Merchant & Van der Stede 4 th edition ) 1 . Play

Raven Capital, LLC pg Merchant & Van der Stede th edition

Play the role of a Raven portfolio manager who has to allocate a bonus pool to the four

analysts working for him. Assume that Raven earns a incentive fee on the total

return and that all of the returns were above the funds high water marks. Use

of the incentive fee as the bonus pool to be allocated to the four analysts. The four

analysts backgrounds and portfolio performance are described in Figures A and B

below. Please review these figures carefully. Then, answer the following questions:

a How would you allocate bonuses to these four analysts? What alternatives did you

consider? Why did you make the choices you did?

b Is there any other information you would like to have had available before making

your decisions? If so which?

c Do you think you should pay out the entire bonus pool this year, or hold some

money in a bonus bank reserve Why or why not?

Evaluate the Raven performance evaluation and incentive compensation system. What

changes would you recommend, if any?

Figure A

Background Information about Four Raven Analysts

Nick Steinberg NS has been with Raven for years, longer than any other analyst. He has a

BA from Cal Tech and an MBA from USC. Nick analyzes consumer stocks, a sector which

performed very well in Nicks stocks were responsible for most of Ravens funds long

returns. He communicates well with the PMs and there is a great deal of trust between them.

James Johnston JJ has been with Raven for years. He has a BS from UC San Diego. James

analyzes healthcare stocks. He is thought to have been a consistently strong performer during his

tenure at Raven. In his stocks generated significant profits for Raven, but the management

team believes that he was not adequately compensated for his performance because the

bonus pool was small. This year James stocks only returned despite the fact that the

healthcare index fund was up His poor performance is explained by his heavy weighting in

short positions. But James was said to have saved Raven $ million by recommending that they

exit their position in a large healthcare provider shortly before the company lost a large

government contract and its stock price plummeted.

Kate Landry KL has been with Raven for years, with a prior industry focus on technology

stocks. She has a BA from USC and an MBA from Wharton. Kates stocks delivered strong

returns, even though relatively little capital was allocated to them. Kates stocks solidly

outperformed the tech indexes, but the PMs were not sure that Kate should be given full credit

for choosing the stocks. She was perceived not to be very effective at filtering ideas. On average,

the PMs estimated that they had to sort through about of her ideas to find one that they were

willing to invest in Although they had not done the calculation, the PMs believed that if they

had implemented all of Kates recommendations that their results would not have been nearly as

strong.

Christopher Chris Frost CF has been with Raven for years. His specialty is financial

stocks. He has a BS from Columbia University. The financial sector was down in and very

little capital was allocated to it But Chriss stocks beat the industry index. He could also point to

a list of recommendations he made that were not implemented by the PMs but that turned out, in

retrospect, to be winners. He insists that he could have earned the fund an extra $ m

Raven Capital, LLC pg Merchant & Van der Stede th edition

Play the role of a Raven portfolio manager who has to allocate a bonus pool to the four

analysts working for him. Assume that Raven earns a incentive fee on the total

return and that all of the returns were above the funds' high water marks. Use

of the incentive fee as the bonus pool to be allocated to the four analysts. The four

analysts' backgrounds and portfolio performance are described in Figures A and B

below. Please review these figures carefully. Then, answer the following questions:

a How would you allocate bonuses to these four analysts? What alternatives did you

consider? Why did you make the choices you did?

b Is there any other information you would like to have had available before making

your decisions? If so which?

c Do you think you should pay out the entire bonus pool this year, or hold some

money in a "bonus bank reserve"? Why or why not?

Evaluate the Raven performance evaluation and incentive compensation system. What

changes would you recommend, if any?

Figure A

Background Information about Four Raven Analysts

Nick Steinberg NS has been with Raven for years, longer than any other analyst. He has a

BA from Cal Tech and an MBA from USC. Nick analyzes consumer stocks, a sector which

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock