Question: A Ltd pays $90,000 to acquire 90% of the shares of B Ltd on 1 January 20x4 when B Ltd was incorporated with share

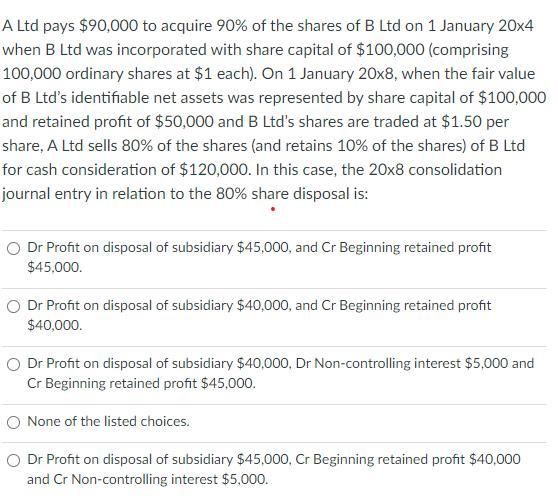

A Ltd pays $90,000 to acquire 90% of the shares of B Ltd on 1 January 20x4 when B Ltd was incorporated with share capital of $100,000 (comprising 100,000 ordinary shares at $1 each). On 1 January 20x8, when the fair value of B Ltd's identifiable net assets was represented by share capital of $100,000 and retained profit of $50,000 and B Ltd's shares are traded at $1.50 per share, A Ltd sells 80% of the shares (and retains 10% of the shares) of B Ltd for cash consideration of $120,000. In this case, the 20x8 consolidation journal entry in relation to the 80% share disposal is: O Dr Profit on disposal of subsidiary $45,000, and Cr Beginning retained profit $45,000. Dr Profit on disposal of subsidiary $40,000, and Cr Beginning retained profit $40,000. O Dr Profit on disposal of subsidiary $40,000, Dr Non-controlling interest $5,000 and Cr Beginning retained profit $45,000. O None of the listed choices. O Dr Profit on disposal of subsidiary $45,000, Cr Beginning retained profit $40,000 and Cr Non-controlling interest $5,000.

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Option e is the correct answer among the five choices given Answer e Dr Profit on disposa... View full answer

Get step-by-step solutions from verified subject matter experts