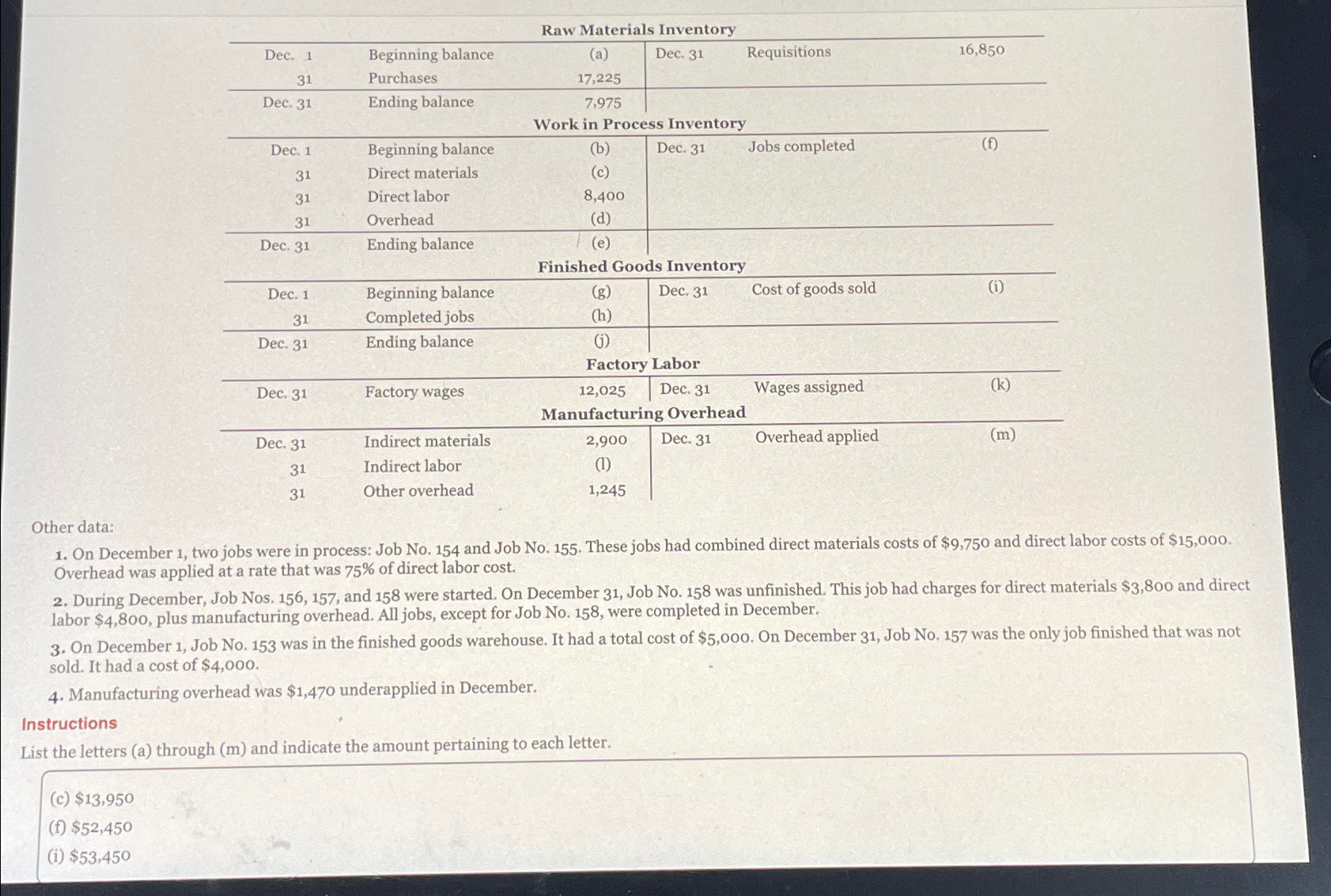

Question: Raw Materials Inventory Dec. 1 Beginning balance 31 Purchases Dec. 31 Ending balance (a) 17,225 7,975 Dec. 31 Requisitions 16,850 Work in Process Inventory

Raw Materials Inventory Dec. 1 Beginning balance 31 Purchases Dec. 31 Ending balance (a) 17,225 7,975 Dec. 31 Requisitions 16,850 Work in Process Inventory Dec. 1 Beginning balance (b) Dec. 31 Jobs completed (f) 31 Direct materials (c) 31 Direct labor 8,400 31 Overhead (d) Dec. 31 Ending balance (e) Finished Goods Inventory Dec. 1 31 Beginning balance (g) Dec. 31 Cost of goods sold (i) Completed jobs (h) Dec. 31 Ending balance (j) Dec. 31 Factory wages Dec. 31 31 Indirect materials Indirect labor Factory Labor 12,025 Dec. 31 Manufacturing Overhead 2,900 Dec. 31 (1) Wages assigned (k) Overhead applied (m) 31 Other overhead 1,245 Other data: 1. On December 1, two jobs were in process: Job No. 154 and Job No. 155. These jobs had combined direct materials costs of $9,750 and direct labor costs of $15,000. Overhead was applied at a rate that was 75% of direct labor cost. 2. During December, Job Nos. 156, 157, and 158 were started. On December 31, Job No. 158 was unfinished. This job had charges for direct materials $3,800 and direct labor $4,800, plus manufacturing overhead. All jobs, except for Job No. 158, were completed in December. 3. On December 1, Job No. 153 was in the finished goods warehouse. It had a total cost of $5,000. On December 31, Job No. 157 was the only job finished that was not sold. It had a cost of $4,000. 4. Manufacturing overhead was $1,470 underapplied in December. Instructions List the letters (a) through (m) and indicate the amount pertaining to each letter. (c) $13,950 (f) $52,450 (i) $53,450

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts